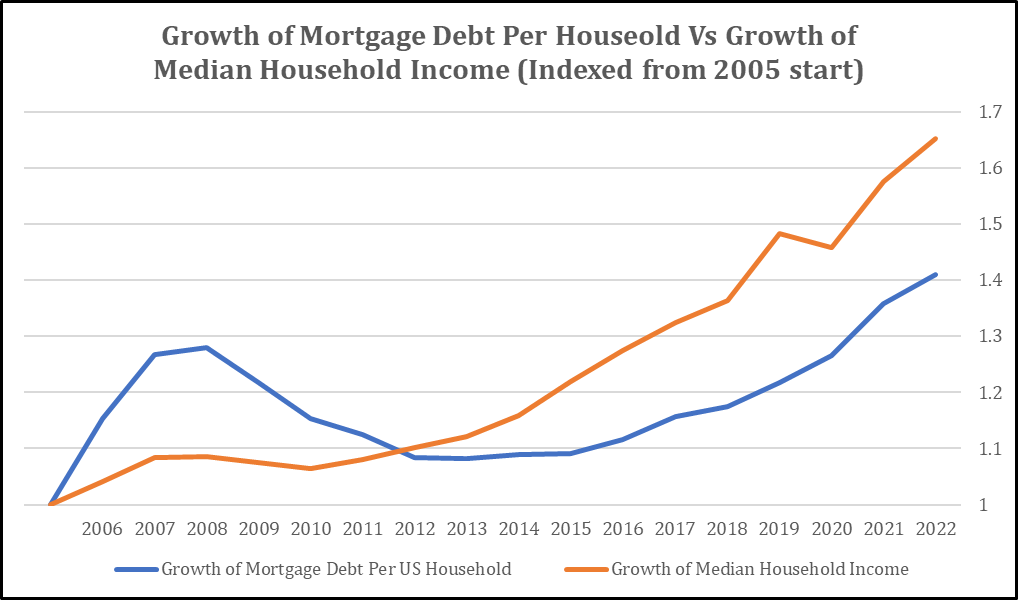

Use the standard 20% downpayment, and current market price of the SFR to compute the monthly mortgage payment.

.

…we assume the purchase of a home at 80% of the current median-priced existing home with a 5% down payment and a 30-year, fixed-rate mortgage…

5% downpayment? Is this the norm nowadays? This make cost of ownership higher than for 20% downpayment. Also, increase in mortgage rate would kick out this 5% downpayment buyers.

Rising rent due to rising property tax from rising house prices eat into my cashflow since rent rises less than rise in property tax ![]()

Rising rent due to rising mortgage rate increases my cashflow ![]() since no increase in cost.

since no increase in cost.

Isn’t it better decision to go for 5% down with 3% rate than 20% down with 3% rate?

.

PITI of 5% is higher than PITI of 20% for same house price and is more sensitive to rate change. So if the norm is to do 5% as down payment, an increase of mortgage rate would bring affordable house price down more than if 20% is the norm.

Also inflate the affordability as listed… too lazy to explain.

Bidding Wars Overheated the Home-Buyer Market, Now They’re Coming for Renters

Competition among renters means many tenants feel compelled to pay more each month than what the landlord is asking

Virginia, Atlanta, Chicago and New York. No mention of Bay Area and elsewhere.

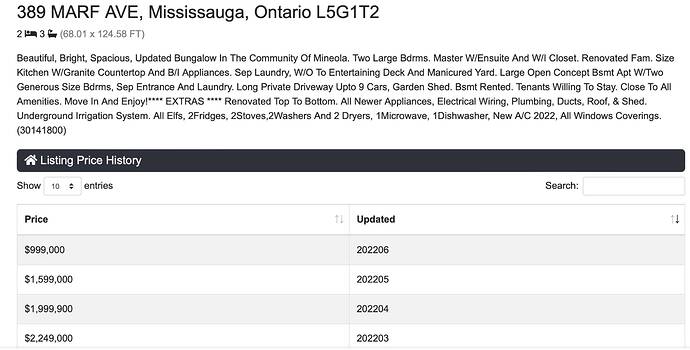

That’s interesting. I wonder what sellers plan to do. Trading up/down seems crazy with rates higher. It makes more sense to stay locked in at or below 3%. Rents are increasing fast, so selling to rent doesn’t make a lot of sense.

.

Sellers’ profile.

Have a Primary + a few rentals

Leaving the city or moving to a new construction and

. don’t want to be a landlord or

. insufficient fund to own two

Probate sale

New construction from developers

Yet another article about rising rent.

House-Flipping Rate Rises, but Investors’ Profits Are Falling

Nearly 10 percent of U.S. homes sold in the first quarter of 2022 were flipped, but investors were challenged by shrinking supply and rising costs.

Ah the details, listing are up 19% yr/yr, but they are half of pre Covid levels. I guess we should pay attention when they double.

Buy a smaller house and work your way up to a larger home. Everybody did that. Mortgage of my first house is over 8%.