Two issues.

Assessment of which ones are overvalued may be wrong;

Likely fall is not the same as certain to fall.

Hence, I can’t use Moody’s comment to make decision.

Observing price cuts on multiple properties. Will be interesting to see if this is a trend and how far it goes.

I live in California (East bay area) and houses in mid range 1.2M-2M are sitting for over a month with majority of them have price cuts. Inventory almost up by 70% compared to April-2022, lot of bargains for buyers. Recently saw a post for open-house offering free Dosa(Indian food) and Tea .

yup seeing same here (also in EB), things are still selling but slowly and usually after a price drop

$400k price cut. Still waiting- Not very familiar with this area except few colleagues live there.

https://www.redfin.com/CA/San-Jose/2241-Datoro-Dr-95130/home/1516989#property-history

Same here also in East Bay. Also seeing low turnout at OH. Price drops after 1 month on the market. Also seeing many neighbors fixing up getting ready to list.

Definitely at a near top. Down turn coming?

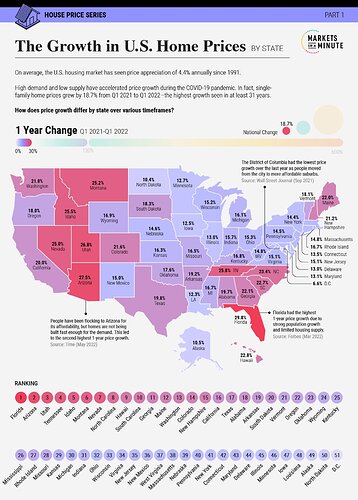

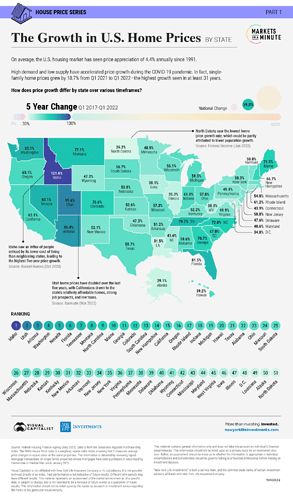

Look like house prices in Texas are still cheap ![]() compare to other tech hubs.

compare to other tech hubs.

What’s the plan? What’s the vision?

.

以不变应万变

No change to deal with all changes since have already considered all possibilities when crafting a strategy.

What was the strategy or status quo? Remind me.

1 a year?

Interesting that since 1991 the national home price increase is a 4.4% average. It definitely doesn’t happen linearly.

Ross Gerger is forced to buy a house at ATH because his wife wanted to buy it. That’s what I did in 2007. So I am not alone doing such financially foolish act. There would be a lot more people like us. House ![]()

Make no mistake: The home buyer pool may be shrinking, but it’s still not a buyers’ market.

“Our biggest concern at the moment, just as it was for the last two years, is the lack of inventory,” Castillo said. “We have hundreds of pre-approved buyers looking for homes that do not exist due to a lack of financeable for-sale homes.”

Despite surging rates, homes for sale stayed an average 17 days on the market. According to Redfin, that’s up from the record low of 15 days posted in May and early June – signaling fast paced buyer demand.

“It’s very competitive and many first-time homebuyers cannot find a home and can’t compete with existing homeowners with all cash offers from their built equity.

If inflation is at 2%, what should be the fed rate and 30-yr fixed mortgage rate?

FED, Jun 15th conference call, indicated long running FED neutral rate is 2.5% for inflation 2%. As per current plan, FED raises rate to max 4.10% (dot plot) by 2023 and then bring it down to 2.5%.

This means that low mortgage rates are history like real estate short sales ! For those who locked 30 year fixed less than 4% must pat themselves as it is going to be history in USA.

Mortgage rates will be decided by MBS market ( or 10 year note rate ) at that time.