Current fed rate is 1.75%

Current mortgage rate is 6%

If 2.5% is the target fed rate, 6% for mortgage rate is still low. So once property market gets used to the new mortgage rates, transactions would resume since demand is still >> than supply.

Lol. What do you think will happen when there’s a recession, and the FED needs to stimulate the economy? There’s about a 0% chance we make it to 4.1%.

True, if recession comes before, rate hike stops, but who can guarantee recession even if yield curve inversion happens?

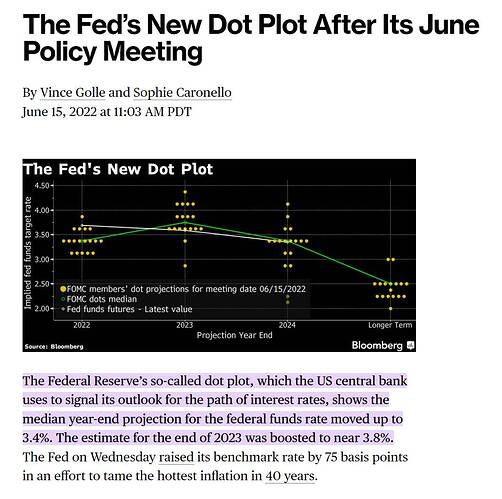

From the above statement, all I understand is that you did not listen FED’s Jun 15th Conference. I am 100% confident on that (proof given below).

The new dot plot gives 3.75% to 4.5% in 2023 which may or may not happen, No one knows about the future, but that is the guidance all 18 FED policy makers are aiming now. Above all, mid-term election results will be major change in USA

Second, I am just posting what was inferred from FED’s conference, that is all. When FED raised 0.75% (no one expected last month) after historic 40 years, anything can happen and anything they can do based on their judgment.

We just listen, follow what they do, and protect our investment.

The fed is a bunch of academic morons. Their forecasts have been garbage for years if not decades. They also won’t surprise the market and only make rate moves after they are already priced into the market. The market will decide what happens, and then the fed will announce rate decisions to match it. The market moved before the fed decided on the 0.75% hike.

The forecasts are about moving the market rather than actual forecasting. The full forecast immediately gets priced in, rather than just the individual rate increase/decrease.

Personally I don’t think we’ll make it to 4%. The country is already in a recession. The labor market is rapidly weakening. Inflation is just food, energy and cars at this point.

I posted a job ad recently and received over 50 applicants in less than a week (heading into a holiday weekend no less). I had to fill a similar position in mid-2021 and received ~12 applicants (only one of them qualified) over the course of a month. Anecdotally the view from the ground is radically different than a year ago.

I simply laugh at these statements…no interest to respond.

Nowadays I feel this way:

If someone thinks wrongly, let it be. If someone understand the world (or surroundings right way), they will reap the benefits.

Both will realize their decision outcome in due course !

![]()

If we get an inflationary recession the Fed may lose control of interest rates and the free market may decide how much inflation premium is required for US debt to be worth purchasing. Then all bets are off. Trying to force rates down by printing money to buy up bonds just forces inflation up. Checkmate.

.

My ideal asset allocation is:

RE (incl Primary) 45%

Stocks (S&P and AAPL) 45%

Speculation (unproven thematic high growth) 5%

Cash 5%

Current % of RE is 30%, so I have to continue to buy, on average, 1 per year.

The market moves on its own. The market moved expecting 0.75% at the key meeting before there were any leaks or rumors. The fed is consistently behind and wrong. Remember when they said inflation was transitory and there was no need to act?

Why 45% RE and 45% stocks. Why not 80:20 or 20:80 or 100:0. RE (with leverage due to debt) outperforms stocks in the long run.

Arbitrary.

RE with leverage compares with S&P without leverage is apple to apple comparison?

Hard to achieve positive cashflow for SFH rental in SB. How to support such endeavor?

Historical appreciation in SB is 6-8% p.a.

Historical appreciation of S&P is 7-11% p.a.

Not really, RE prices have gone up at at least 5% over last 2-3 decades in SB and assuming 2/3 leverage, your returns may be 10+%. Add tax benefits to that if you are into rental business.

SFH yes, MFH not really. You can still buy MFH that cash flows with 1/3 down. With rates going up, prices may fall which will make it even more attractive.

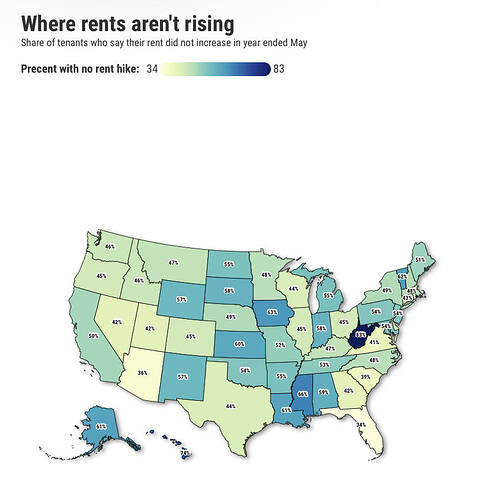

I raised my rates from 5-10% . Only one tenant complained. Empty apartments I raised to a little bit below market rents

All your units in Tahoe area or elsewhere too?

.

You may not have included all expenses. I account for opportunity cost, risks and accruals.

Ditto for MFH. Many issues and expenses are not accounted for which make SFH seems not as good.

I am not too far from there, 55:40 to RE with 5% to random stuff like Crypto and TIPS. I want to maintain 60:40 to Stock so have been fueling into stocks with DCA, hopefully long term it will pay off.

My ratio is highly skewed towards RE. Probably 75 RE to 25 stocks I think. I want to be more skewed towards stocks but also do it more methodically ie I don’t dare do ‘all in’ like some of you do.