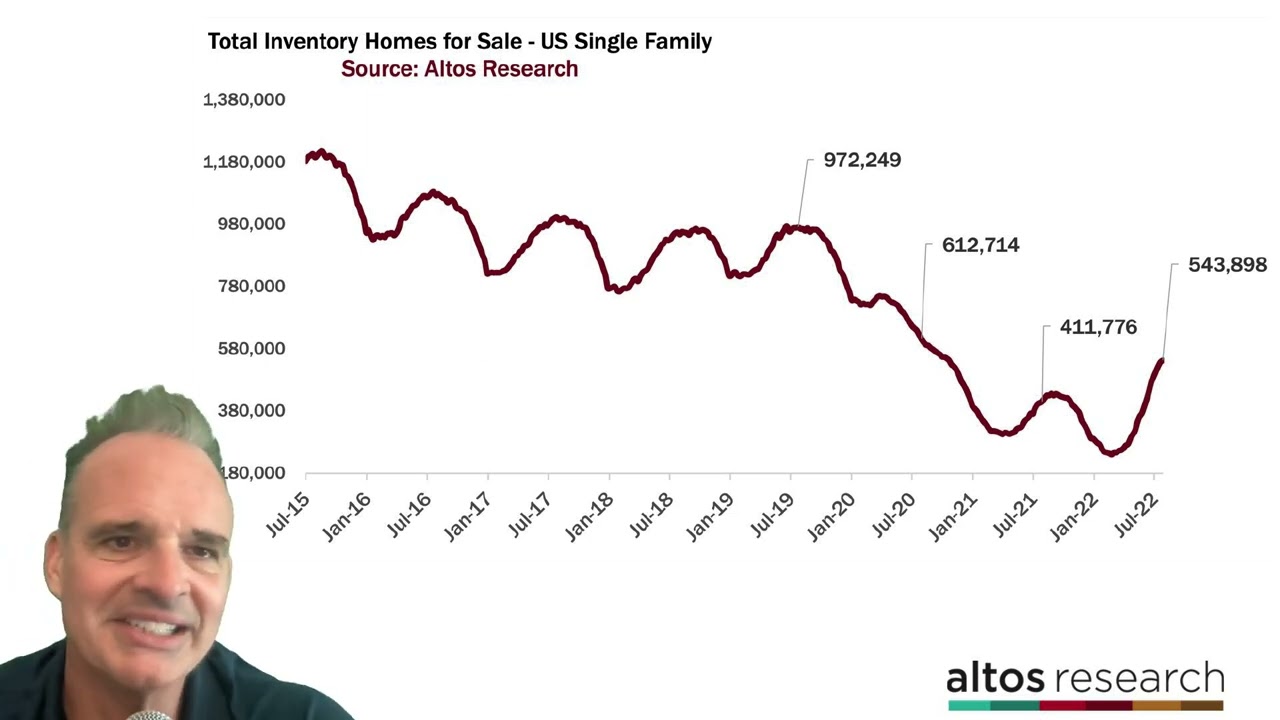

Still very low inventory, high employment and a shortage of housing in most markets. A soft landing seems most likely. Prices have not dropped nationwide and inventory increases are leveling off.

Zillow prices are now showing @15% down since May in Sunnyvale,San Jose, etc.

.

Zillow is cruel to my CU homes, 18-20% down ![]()

Nice to Austin homes, about 10% down.

Where will it stop?

Inflation will run high for at least 3-4 more months. Fed will continue to tighten. Things look very bleak till the end of year.

Black Lives Matter is still buying more mansions. With checkbook liberal money. Great idea for ideal wealth distribution

Who cares if they stiff a bunch of rubes dumb enough to give them money. What concerns me is all the property damage and violence they instigate.

I am enjoying their facilitating the transfer of liberal’s money to my industry. The more the better. Means less money to give to rioters.

Meanwhile Tahoe prices are still holding up.

https://www.realtor.com/realestateandhomes-search/South-Lake-Tahoe_CA/overview

Normally prices bottom out in Dec, Jan and it is still July. Looks very bleak for Bay Area RE. Fortress still holding up but 3rd tier towns and SF city have half crumbled. Is Dec, Jan is good time to get back on to market or will the decline continue to 40%, 50% or more.

Bay Area seems to have all ingredients for a huge crash: record high prices, poor quality of life, homeless everywhere, bad CA policies, businesses leaving, little to no immigration, population decline, tech layoffs, tech stock bear market, high interest rate, record vacancies, work from home, the list goes on. There is literally nothing positive for Bay Area except weather, which is equally good or better in many other parts of the world.

.

Scan through social media, influencers predict bottom varies from Dec/Jan to 12-18 months later. The reason for the difference is their views on recession (mild to severe).

The SF population decline is crazy. I wonder how much of that is permanent.

Even the progressives seem to be getting tired of the crime, drugs and homelessness there.

Unfortunately SF residents by electing such politicians seem to be exporting these behaviors to rest of Bay Area.

Seems to be down everywhere. 15% minimum and still going.

SF population declined 100k from 1967-1982. Blame the hippies the progressives crime and urban decay.

You need to look at history. BA prices have really only dropped to those levels in 2008. A government caused financial crisis by allowing 125% non qualifying loans inflated house prices and a correction occurred. But only lasted 2-4 years.

Price drops previously were minor and localized. Even in the 1930s BA prices didn’t drop. Since WW2 there was a huge building Boom. The seventies are similar to now. However more houses were built and prices went up even with inflation and high unemployment. Since the 1980s demand has out stripped supply. There is a housing shortage. Especially of sfhs. Prices may drop 10-20% just because the overbidding got ahead of itself. But I doubt anything like the 2008 financial crisis will occur

. Meanwhile building costs keep going up. Plenty of buyers waiting for bargains it there are sellers desperate to sell.

- The National Association of Home Builders/Wells Fargo Housing Market Index dropped 6 points in August to 49. Anything below 50 is considered negative.

I always think Bay Area RE troubles are national RE troubles multiplied by 10 due to all the headwinds Bay Area and CA is facing. Things look very gloomy and I am amazed by (just a few) folks who are still buying and overbidding in Bay Area.

.

Vested TSLA stocks? Staying in SB has the status of being viewed as an outstanding SWEs and “rich”.

Maybe. I know one family who work in TSLA and bought home in April in Mountain House at the peak for 1.5. Similar homes are now getting listed for around 1M now. Easy come easy go.