Fed does not have backbone to do that. Real interest rates are negative 7% and they are debating over 50 vs 75 bp hike.

How are you defining debasing of USD? What currency are you comparing against and what time horizon?

I laugh such comments and it is fun to hear such nice logical comments !

It is like this.

When my friend, came from overseas, first time and sitting next to me, giving me lecture how to drive in crowd, highway.

I told him, do not comment on my drive unless you drive on highways on your own, you would not know the issues. He challenged me and I told him to drive the rental car when he comes back to USA in future.

That guy came at least 10 times in next years, never drove any car. When I asked why not drive the car, he replied that he wants to live longer…

LT is ![]() for the same reason I mentioned below

for the same reason I mentioned below ![]()

Waiting for Fed to do the necessary ![]() to push sellers into motivated sellers.

to push sellers into motivated sellers.

Meaningless to define debasement in terms relative to other currencies being debased. Purchasing power is the only meaningful metric.

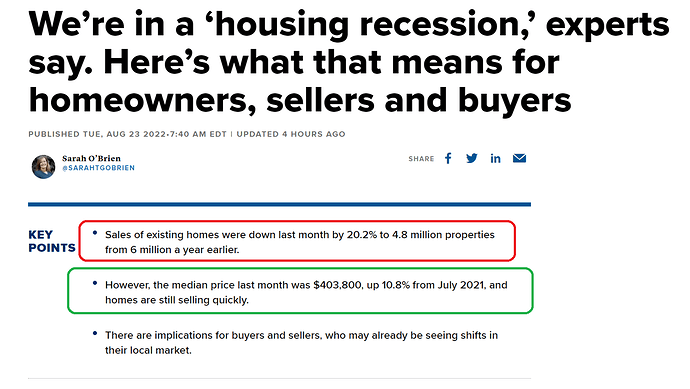

Wolf published another article on housing bust but in the article he ignored the fact that home prices actually increased in July over June. Still he is preaching the same choir of house price crash.

I added the following comment in the article and he apparently deleted my comment, haha. Classic SF resident - silence anyone who disagrees but preach about liberty and free speech to everyone.

Looks like he is running yet another doom and gloom channel to attract the horde of perma bears and losers as his audience. Doom and gloom sells. But he is misguiding everyone about RE investment. He was also a TSLA basher, he has been calling for fall of TSLA for many years in spite of being proven wrong very badly.

------- My comments that he deleted -------

Prices are not coming down, it has plateaued. In fact last month prices went up so claiming prices are falling is misleading. Given that construction cost is at record high and inflation (in labor, material, permit, etc.) is at record high and land costs are at record high, RE price growth is a natural outcome irrespective of demand or supply. RE in the end is a business and if input costs are higher, output costs got to be higher, its common sense.

And none of the input costs are going down (land, construction and inflation). So, I stick with my prediction that volumes will drop and RE prices will pause for a while and once we get past recession, RE prices will resume going higher. All these doom and gloom predictions will be proven wrong, yet again. But it will definitely attract more viewers to this news channel.

I thought your were a bear. I am neutral. But if a high end home dropped 50% I might be a buyer. One could always hope.

Inventory seems to be dropping and costs keep going up . Hard to pitch the bear scenario.

I am a bear because I am looking to invest more but data so far shows that there will not be crash, not yet. There are really no signs. Listing prices are actually rising which says a lot about sellers mindset. They will not budge looks like and wait it out. Sellers are generally wealthy people and they can afford to wait out and outlast the buyers. Lets see.

.

![]()

Crash means 20%, 30% or 50% from ATH?

The increase of 2.5% to 3% of mortgage rate reduces buyers’ buyable home prices by 25-30%. Currently in Austin, excluding isolated cases, price has declined by 5-10% from ATH in May.

https://www.zillow.com/homedetails/5719-Dimas-Ct-Pleasanton-CA-94566/72700238_zpid/

^^ Sold just now. Price went up by 125% in 2 years when it sold last. This is East Bay.

What crash? What recession?

Looks like this housing market will defy all predictions and common sense.

At least 25% would be my definition, but more like 40% would be crash according to me and I would be all in the Casino

10-20% drop is noise, such volatility is always there in any market TBH.

.

First transaction is arms length? Or this is going to be the behavior. Notice, hardly drop and then plunge. One thing for sure, zessimate is not reliable, I suspect something fishy, feel like intentionally give very low zessimate.

Stock market’s definition,

Less than 10% Consolidation

10%-20% Correction

More than 20% Bear market

Crash = 30% decline from ATH within a month or 10% within 3 days.

RE is a slow motion movie, may be can define a crash as 30% price decline from ATH over 1 year.

Can happen if mortgage stays above 6% for a year and unemployment rate increases to double digit.

Don’t use the word, recession, meaningless term, so butcherised that it is no longer mean anything.

https://www.zillow.com/homedetails/946-Montgomery-St-San-Carlos-CA-94070/15551957_zpid/

^^ Just sold. 50% price rise in one year. So far all talk of Bay Area crash is just talk.

Um, you’ve been the one talking up that there’s a crash happening.

Yes but so far based on date, I have been wrong.

Did you look at the before and after photos and description? Here’s part of the old description

One owner for last 43 years, now it’s time for a new owner. 2 bedrooms, 1 bath, plus additional room from converted garage space.

It’s not apples to apples house comparison of 2021 to 2022.

Prices since May 2021-May2022 was up say @50%. Since then it’s down by 20%. So 1.5 * .8=1.2. $1.3M*1.2=$1.56M(without any new addition and upgrades).

Increase in value = 1.9-1.56=$440K. Profit = $440K-(cost of all the work +taxes)

Check below for older property history.

https://www.redfin.com/CA/San-Carlos/946-Montgomery-St-94070/home/1991547#property-history

The listing went down not the price

Your post is half truth, see here correct one. This means people are not selling/listing homes.

Its a stalemate.

Who will blink first, sellers or buyers?

Keeping in mind that

- sellers are sitting at 2% mortgage

- can easily rent their property in high rent environment

- are usually high net worth people

Sellers will most likely outlast the buyers.

What do you folks think?