Any spending by Govt. would cause inflation.

Bad analogy. More like investing in an elderly BA vs a youthful Austin. Elderly always have better track record initially ![]()

keywords are highlighted below. Govt doesn’t care if inflation increases after the elections are over.

If that rental I posted is any indication rents are weakening. No good applicants for $2400 a month with utilities included and not far from Google. Just two problematic ones.

Still 5 caps available South Lake Tahoe multi family and even a few sfhs.

Unit looks out-dated and will be unappealing to tech crowd. Your friend needs to make some updates ![]() What I noticed is fresh out of college crowd likes luxury apartments and a bit older are either looking to buy or can rent SFH…

What I noticed is fresh out of college crowd likes luxury apartments and a bit older are either looking to buy or can rent SFH…

For modern condo and apartment units, rents are super high. New apartments in MV, LA, are demanding 7-10K for 3bd2ba.

.

![]()

From CBRE

The cap rate expansion since early June has been relatively modest at the high end of the market. Property sales have been dominated by all-cash buyers as well as industrial and multifamily investors willing to accept some negative leverage due to their expectations of continued strong rent growth. A 60-basis-point decrease in the 10-year Treasury yield since June 14 has also helped to temper the decline in high-end asset values. On the other hand, cap rates at the low end of the market have widened significantly since early June due to debt market illiquidity for the riskiest assets.

Nevertheless, property investment markets have been more active than they typically are during turbulent times. Total volume rose by 10% in Q2 2022 compared with the same period in 2021. The continued strong volume was driven by investors offering more new deals to get ahead of further interest rate increases and to monetize strong gains in multifamily and industrial assets despite some softening of pricing this year. Out-of-favor office and retail assets also saw higher volume as investors were attracted to the positive leverage (going-in yields higher than the cost of debt) still available.

.

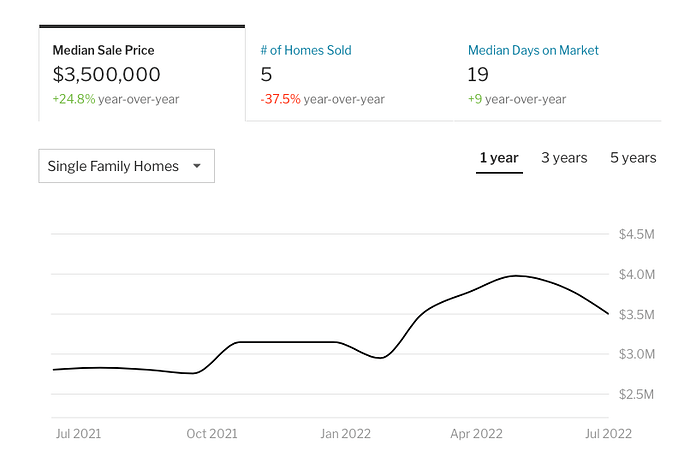

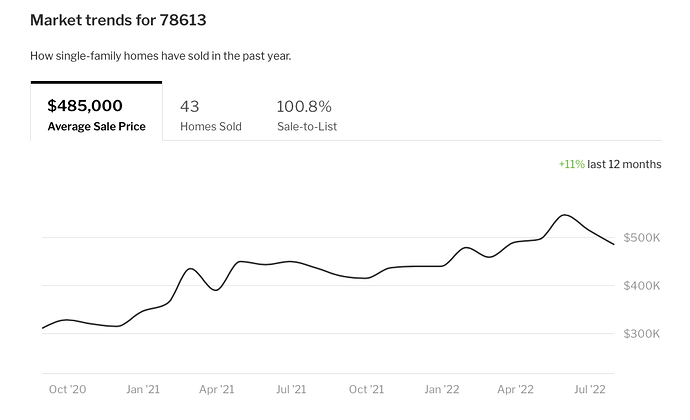

Outdated. Market froze in Aug. Price peaked in Apr-Jun depending on where.

Btw, y/o/y prices should increase till end of the year while m/o/m prices should decrease till end of the year. Nothing to see if pundits say above.

If fed keeps increasing rates, we will see both m-o-m and y-o-y prices decline well into next year. Prices have to come down to levels where it is affordable to buy with a 20-30% down payment

I have been looking at recent listings in Bay Area. Most high end listings (3M+) are 20% above market (Zestimate). Looks like sellers are in denial and not willing to sell at any lower than April prices. Given limited inventory it will be interesting to see how it pans out.

The highend is illiquid. Good time to shop for the weak ones in the herd. Time to start making lowball offers on the ones that drop their prices. I just talked to a young investor that picked up too run down apartment buildings in South Lake Tahoe. Bought two under market 36 unit buildings during the fire. Buy when the house is on fire, blood on the streets, or mud on the streets. Maybe during the record flood due next year…lol

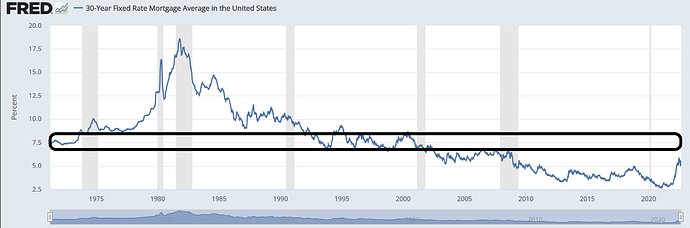

IMO, interest rates need to be in the black band below for a healthy housing market. In name of stimulating economy whether post '09-12 crisis or more recently covid, Fed’s monetary policy has kept rates artificially low for too long leading to astronomical housing price gains. Its not too difficult to anticipate what will happen as sense comes back to Fed and they bring the rates back up. And most likely they might overshoot this band first before easing rates again. (They did overshoot to the downside!)

But don’t you think that the pain and realization of pain has not yet peaked? End of year will be a good time to step back in the market I think. To me a deal is if I can get at a price lower than 2018 price because interest rate now is already and headed much higher than in 2018.

I agree. Now is the time to shop . Winter is the time to buy. Hopefully during a flood… we need a biblical one. If we are lucky it will flood Sacramento and wash the whole state government out the Golden Gate like in 1861-2. Sacramento was inundated with 10’ of water after 2 decades of drought( before global warming ) . Let’s pray . Gets rid of drought and progressives all at the same time.

The market movement will be determined by if they are:

- People who are willing to sell for peak market price

- People who have to sell regardless of the price

Unemployment is still very, very low. It obviously depends on each individual, but the overall statistics on the financial stability and equity of home owners are strong. It seems unlikely a large number of people will be option 2. If they can’t get the price they want, then they’ll de-list and wait for better timing.

I think people forget 2008 was caused by an unprecedented liquidity crisis. The mortgage market literally froze, and people couldn’t get loans once MBS were deemed toxic assets. In July, 2007, the first Bear Sterns credit fund collapsed. The mortgage delinquency rate was only 2.29%. The issue was lack of liquidity in the bond market and mark-to-market accounting. We didn’t enter a recession until Q1 of 2018. The delinquency rate didn’t peak until Q2 2010 at 11.08%. That’s what it took to crash RE by that much.

It’s also why the fed is so paranoid about market liquidity. They could have entirely prevented 2008. In 2007, they needed to start buying MBS at par value to allow banks to mark-to-market the prices as par.

Some people claim that the bubble now is much bigger than bubble in 2008 because price to wage ratio now is higher than in 2008. We are also in everything bubble now compared to 2008. Literally everything is inflated. And our debt levels are way higher than it was in 2008, both govt and private debt. It is the biggest bubble ever. Everyone knows that the total debt cannot be repaid EVER and whatever we are doing is only going to kick the can down the road. The longer we wait the bigger the crash. Having said that the later may be many many years later, no one knows.

Manch thinks we’re in the Roaring 20s. So if you plan on dying in 2029, leverage to the max and go for broke. But there will be hell to pay in the 30s.