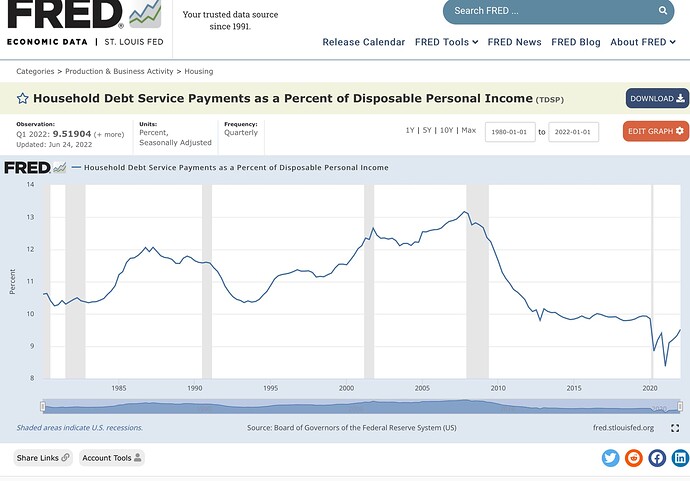

People might say that, but it’s not true. Households also have much higher savings now than 2008.

Going forward, the likely scenario is:

Mortgage rate stays above 5% (some say 7%), declining inventory, declining transactions. So what about price? Who are the buyers? Investors ![]() ?

?

Potential first time buyers ![]() Cheaper to rent.

Cheaper to rent.

Move up buyers ![]() Can’t sell, no buy. Can’t afford higher mortgage interest.

Can’t sell, no buy. Can’t afford higher mortgage interest.

Mortgage using Investors ![]() Rising rent can’t pay for high mortgage payment

Rising rent can’t pay for high mortgage payment

Cash investors ![]() Waiting for motivated sellers to cut prices drastically

Waiting for motivated sellers to cut prices drastically

When would sellers become motivated?

Loss of jobs

Business bankruptcy

Loss big in stock trading

Divorce

Transfer out of town

Inheritance

Previously entered contract to buy new construction due

From the Fed minutes, if Powell is not lying then we are up for significant RE pain. He said we will keep raising rates till we bring inflation down to 2%. This may mean 4% or 6% FOMC rate, we will see how inflation reacts to continued rate increases. Some claim rising rates may even add to inflation initially till we get to positive real rates. This implies mortgage rates of 6% or 8% or even higher. RE can easily crash by more than 50% if this scenario pans out.

I personally think Fed is lying and they will give in and U turn after raising rates to 4% when everything will begin to crumble.

Inflation will unwind much faster than people think. Just look at all the data pointing to record inventory levels. Sales are slowing. Prices will need to drop.

With today’s conference FED clearly indicate the rate hike until inflation under control. Personally, I am convinced (guess work) we are leading to a recession from here.

Mortgage rate follows 10Yr yield. If FED increases 0.75 (or even 1% - even today indicated unusual rate hike), 10Yr may stay or slightly down and this is the lowest.

When 3M yields are going up, 10Yr will also increase for some months and stay there.

Since FED was telling current FED rate is long term neutral rate, most likely we will see 30yr fixed stay around 5% long term.

Who are the buyers? Investors => Yes investors move from stock to 10yr or similar bonds.

- As long as our Govt will keeps spending like a drunken sailor inflation will never come down. And Dems have no intention to stop.

- Plus keep in mind that China is stimulating their economy and soon they will suck in all commodities, oil, and goods and so will the rest of the developing world as the gap between them and West closes.

- USD will slowly lose its reserve status and power that comes with it.

- Its so foolish that West tangled with Russia which is a true commodity and Oil superpower, they literally control a quarter of the world’s supply.

- In the end China and developing world will benefit as they will have access to cheaper commodity and oil.

- The future will be dictated by supply not demand.

All of these will cause unprecedented inflation in US and Europe and standard of living will go down.

Isn’t the government spending $1.7T less this year than it did last year?

China’s economy is on life support.

Yawn. You must read zero hedge who’s been doing the same fear mongering for 20 years.

The US outproduces Russia.

Which commodities other than oil?

We already have more supply than demand. That’s why we have record inventory levels. Supply issues are a BS cover for execs who have products that aren’t selling.

Inflation is already declining qtr/qtr. Soon, we will be comparing against higher numbers from last year. The yr/yr number will shrink to under 2% by Q3 of this year or Q4 at the latest.

.

By recession, what unemployment rate are you expecting?

Once people get used to it, home prices would resume upward trend. ST, some people panic.

Park their cash while waiting for well priced homes ![]()

.

You have spent too much time reading the doom and gloom YouTube videos.

Yes ![]()

I agree with @REInv on these points of his. Have deleted the prognosis on 50% RE fall(because I have not done any study/research/reading on it).

Volcker was the worst thing that happened to me personally except maybe Greenspan with his loose Loan policies . If Powell wants to be Volcker we are all screwed. But most likely he is not.Volcker

No idea, hard to guess !

.

“Sellers are sitting on record equity gains from last year and they locked into very low mortgage rates last year. So it’s not really a good reason for homeowners to sell right now, especially when they see that the market is soft,” Fairweather said. “They can just hold on and wait.”

Doesn’t sound very logical. Don’t lock the profit and let the profit erode is a wise decision?

All I’m seeing everywhere is empty shelves. Even at Walmart.

It depends on the time horizon. Transaction costs are high. Plus, I have no idea why people don’t address the where will the people live after they sell issue. Rents are high. Mortgage rates are higher than most home owners are currently paying. Unless they are forced to sell or downsizing, what is there to gain by selling? The vast majority of homes are owner occupied not rentals. Something would have to motivated owners to sell their primary residence.

If inflation stays pegged in the double digits for years we are also screwed.

That’s weird. My local grocery store has been running buy one, get one 50% off for weeks now. They are discounting a ton of stuff. Home Depot’s shelves are stocked to the top. They’ve also started reducing prices. The new price tag includes what the price was before.

I know this logic but is not what author uses. He uses “record equity gains”. Agree that not much info provided and since if owner-occupied makes no sense to sell, have to assume is an investor. Got low mortgage rate is not a good reason to hold, cash is king.

For half the items I’m looking for I’d love to just get one - at any price.

And some prices are just absurd. A plastic shipwreck aquarium decoration for $80 at PetSmart.