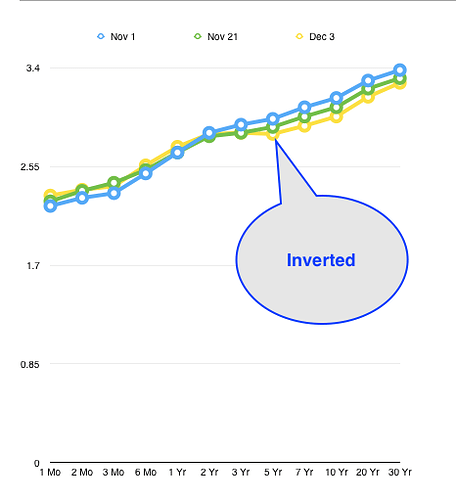

Only one year is inverted. Didn’t follow previous inverted yield curve so no idea how inverted is inverted to start a recession.

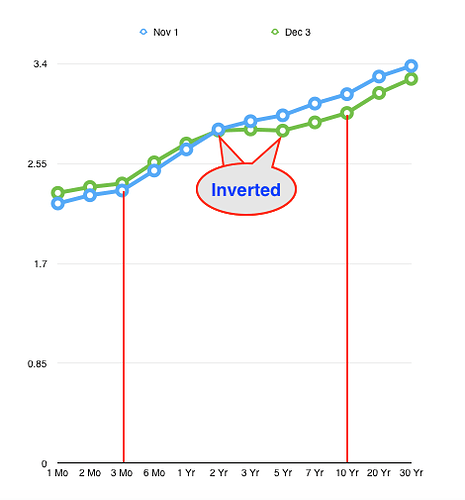

On Monday, the yield on the three-year Treasury note surpassed its five-year counterpart. That bond-market phenomenon, known as a yield-curve inversion, is seen as a recession signal. But typically the recession doesn’t come until years after and many traders won’t see the inversion as official until the two-year yield rises above the 10-year yield.

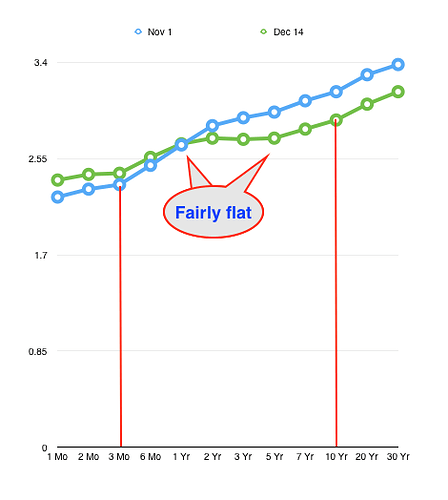

I thought 3-month vs 10 year yield inversion was the barometer.

Yes, this is correct yield curve, rest are speculative pre-cursor. When 3M-10Y fails, it may take 3-6 month before actual fall.

How often is an inversion a clear indicator of recession?

In theory, it should create recession 100%. The simple reason/justification how it works:

Normally, banks find a borrower, lend them ARM, fixed or commercial term loans ranges 3 to 30 years.

During this process bank, as a service provider, borrows from underwriters and lends it to borrower.

Or

Borrow from another bank (Temporary) - inter bank transaction (FED fund rate) - and lend it to borrower.

When short term rates (3-month) are higher than long term rates, they can not find any underwriter for longer term loans, neither profitable to borrow from another bank using inter bank transaction.

When someone is able to get 4% return on 3 months low risk loan, why would someone lend for 10 year 3.75% return?

When this situation prevails for six months, The banking lending operations reduced or stand still for six months, companies won’t get financing, people won’t get financing.

Since our economy runs credit based, most of the purchasing power is diminished, resulting revenue and profit loss for companies…etc

IIRC, since 1900 onwards, but I have this document proof since 1960.

If you remember, this had happened exactly in year 2008 - six months no mortgages for any one - entire real estate market dropped as no buyers until USG/FED started funding the mortgages.

Where did you get this definition? Every articles, say 2 yr vs 10 yr. For example…

Meanwhile, the 3-year Treasury note yield broke above its 5-year counterpart last week. This “yield-curve inversion” stoked fears that a recession could be on its way. Still, many traders believe the inversion won’t be official until the 2-year yield rises above the 10-year yield, which has not happened yet.

3 month is more accurate of an imminent recession. 2 year generally has more room for course correction, whereas 3 month means immediate recession soon to follow. At least that’s how I understand it. Below is the FR of SF’s article on it.

FED New york is also mentioning 3M-10Y

https://www.newyorkfed.org/research/capital_markets/ycfaq.html

Does it invert before a recession or once the recession starts? The fed has more tools than just rates. They could also change the yield curve based on which maturities they decide to buy or not buy as bonds mature.

Inversion happened first, bank suffer on profit margin, sales etc, then recession starts, deepens. We can not assume the same now as FED raised rates slowly, no idea when it will happen.

What could be the impact of the corporate bubble burst? I think it’ll lower mortgage rate and benefit real estate owners. On the other hand, it could cause job loss.

2-3 year yield inversion happened today. 2>3, 2=5. Bad sign.

For the past 9 days, 2>=5 every day. It’s reliably inversed. Need to sell, sell and sell!

Just look at the charts of BAC, FITB, RF, SIVB, DFS, USB,JPM, MS, GS and WFC or any other banks.

They are disturbing. Banks 50% of operations is Maturity transformation (buy short term low rate and sell long high rate).

This is being affected now.

Rest, major is IPO/Seconday/Bonds funding commission and under writing. This is crazy and banks are getting into issues

The 2 and 3 are just slightly inverted; the rest of the curve as of Friday looks normal.

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

It’s finally here. In overnight market though. Watch carefully tomorrow.

No need to watch. FED is firm. I listened Powell statement.

With current one and next two rate hikes, inversion will happen, banks will struggle, all IPOs ( whoever comes ) drops deadly. Looks like recession is imminent in 2019 ( started oct 2018) and completed in Mar 2020 ( not 2019 as FED hiking two more in 2019 ).

Lay off will come and all sectors will have issues.