Multi-millionaires like you guys should not worry about how much an egg costs. Just pay up and eat as many as you want. Who cares if it’s $5 a dozen or $8? How many can you possibly eat a day anyway.

There was a rich b’jillionare athlete quoted some years ago, I forget whom, who refused to pay outrageous roving charges on his cell. Would just get back to folk later.

It’s the principle of the thing ![]()

Prices in South Lake Tahoe up 8% y over year

You’re absolutely right. But my Russian wiife remembers having no money and waiting in lines for food. Food is an emotional thing when you see the prices change every day. Like gas or other things you buy everyday . I think it comes down to the feeling of being ripped off… like the utilities jacking up their bills… I have a house that’s empty with temp kept a 55. . the gas bill was 164 in November and went up to 264 last month. My wife insisted i call and complain. I called Southwest gas . Talked to a customer service person in Texas. Even she couldn’t figure out the complicated bill. 6 pages of unreadable crap.

Now to make you and your wife’s blood boil, get to know CA’s cage-free chicken law:

Implementation of the law began on 1 January 2022. That means all eggs produced in California must be procured only from hens in cage-free housing.

Maybe you should do your shopping on the Nevada side of Tahoe.

It’s affecting egg prices everywhere. Hopefully other states ramp production in response. Or more people just start keeping chickens.

All those trips down the I5 when I was moving. Seems incredible this chicken law got passed and yet we still have “Cowschwitz.” If you’ve ever driven the I5 you know the strip I’m talking about.

I really don’t like eggs . But I use them for cooking. The price will drop. We do buy eggs at Carson Costco. But we have been hibernating this winter. The roads are full of snow and tourists. BTW my wife wants chickens on the farm… Way too much work. Plus they don’t produce much in the winter. I am not sure how the commercial producers deal with that

Tahoe market will decline slowly and less because it wasn’t in the bubble territory like Bay Area.

Bay Area prices were just unsustainable and Covid and remote work pricked the bubble. Air will keep coming out for another year or two. Be patient.

Many bay Area homes are selling at 2017 prices already. SF is in free fall. Plummeting like ball of lead in water. And it’s well deserved.

Costco AAA organic/ cage free eggs $8.29 for 24 eggs. Fair?

Btw, there is a super charging station there. So doesn’t matter you are driving ICE or TSLA, you are good ![]()

Can you show examples? What I found is that non-desirable / needs work kind of homes are the one here. Good homes in premium locations don’t seem to be affected much.

Many examples.

Even in Palo Alto which is top location.

https://www.zillow.com/homedetails/425-Fulton-St-Palo-Alto-CA-94301/19466665_zpid/

Sold for 3.2M just now. Zestimate in July 2016: 3.2M.

Many ppl who bought in 2021 and mid 2022 are now selling at over 1M loss. Well deserved.

Another example:

https://www.zillow.com/homedetails/151-Melville-Ave-Palo-Alto-CA-94301/19496952_zpid/

This sold at zestimate of 2014. Haha.

If you compare with Zestimate, then true. However, the first one is a 3/2 starter home and second is close to train tracks?

Those starter homes and train tracks are in 94301 and sold at nosebleed levels just 9 months ago.

PA prices don’t matter. Only Wu bought there . And he lost $16m with Tesla and isn’t bothered. . PA is on its own. I remember buying tear downs there in the 80s. My former house in Emerald Hills is probably down 20% from its theoretical all time high but still 50% higher than I sold for in 2015

Deflation exerts significant downward pressure on the real estate market, leading to a decline in property prices and reduced investment demand. This negatively impacts the profitability of real estate businesses and impede economic growth. Hoping for a better situation in the coming months.

That’s a huge move for one month. Bonds are rallying.

Very informative news.

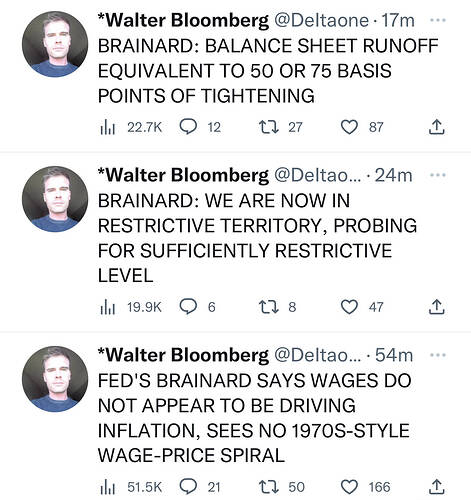

Wholesale prices fell by 0.5% in December, which is more than expected, and retail sales also fell. The producer price index (PPI), which measures final demand prices, declined by 0.5% for the month, the biggest monthly decline since April 2020. Excluding food and energy, the core PPI measure rose 0.1%. For the year, headline PPI rose 6.2%, the lowest annual level since March 2021, and down considerably from the 10% annual increase in 2021. The sharp drop in energy prices helped bring the headline inflation reading down for the month. The PPI’s final demand energy index fell 7.9%, and wholesale gasoline prices fell 13.4%. The final demand food index also fell, declining 1.2%. It is also worth-mentioning that the trend in inflation has been slightly lower, consumer price index decreased 0.1% in December. However, the lower inflation numbers are expected to impact Federal Reserve policy, which may raise its benchmark borrowing rate by 0.25 percentage point in February.

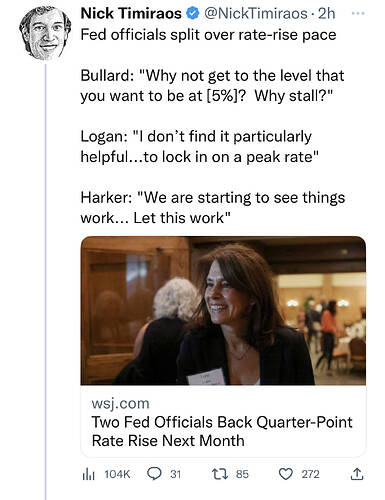

Fed officials are busy making speeches to set market expectations. Looks like a 25bps hike is more likely than 50.