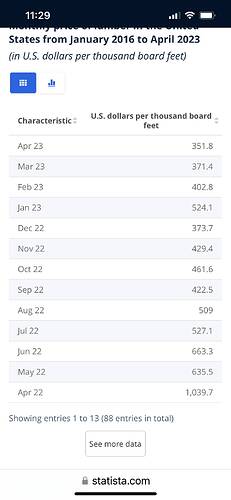

home depot keeps discounting stuff…they must be seeing a drop in buying for sure.

What drugs do the fed members use? I really want to know.

.

Builders are making banks.

Rolling inflation. Melamine and glass have shot up this year. I don’t have stats for either; just tried to buy some.

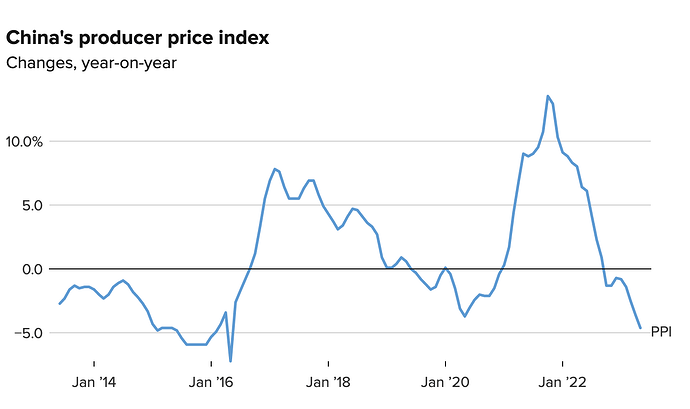

Meanwhile China’s PPI has fallen two months in a row. The Chinese are worried about deflation there.

Producer price index in May fell 4.6%, marking the steepest year-on-year drop in seven years, when producer prices saw a year-on-year drop of 7.2% in May 2016.

The latest reading fell further from a decline of 3.6% in April and lower than expectations to see a decline of 4.3% in May, according to Reuters poll of economists.

But China’s share of our imports has been falling, so the effect on us may not be as big as in the past. Still that should help push down our inflation somewhat.

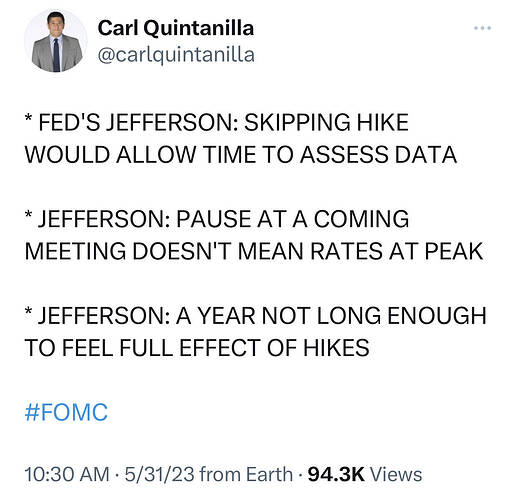

Meanwhile, the fed keeps saying that it’s >2%, so they must keep increasing rates. We haven’t seen seen the full impact of the last 5-6 increases in the economy yet. Even they admit it takes 12-18 months to see the full impact of an increase. I really wish they’d get those type of questions. If they keep increasing until we’re at 2% inflation, then they would have over tightened by a material margin.

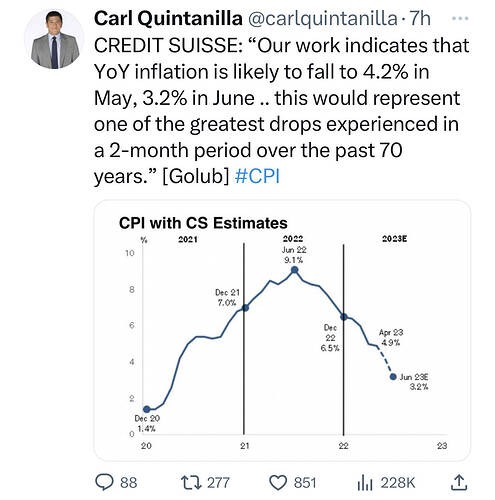

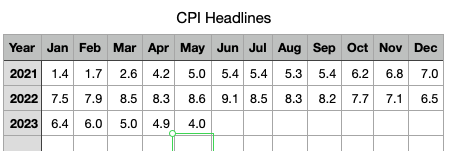

Great chart. Funny how the “secular inflation” everybody screamed about only lasted 18 months. And China is now in outright deflation.

China’s deflation is a huge story that weirdly grabs little attention. Remember back in the GFC we were all scared to death about deflation? That it would be like the black hole that sucked Japan in for 30 years and won’t let go? Bernanke had to resort to QE, unconventional tool at that time, to fight it? But now the 2nd biggest economy is in deflation and everyone just chills? That doesn’t sound right.

Manch, people were freaking about inflation because that would cause fed to raise the rate and that would cause the deflation and slowdown. So, we are at step 2. Having said that, I don’t know whether it’s boom time or recession time from here but one can justify both scenarios.

People calling for “secular inflation” were saying back in 2021 that in spite of what the Fed will do we will be in hyperinflation. The only episode of inflation they knew about is the 70s. That’s why anytime there is a bit of inflation they all immediately pattern matched to that period. Not just inflation, but stagflation.

So they are wrong on both counts. Inflation is now coming down fast. Not secular at all. And economy and job market are both as strong as ever. No stagnation either.

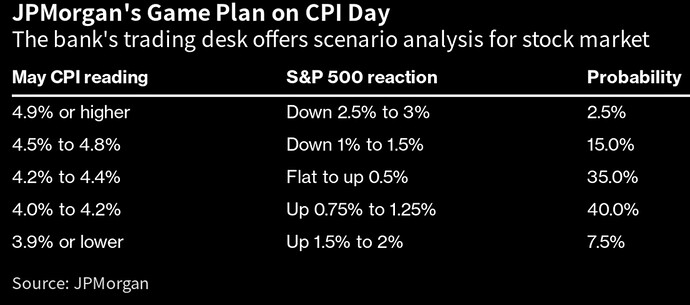

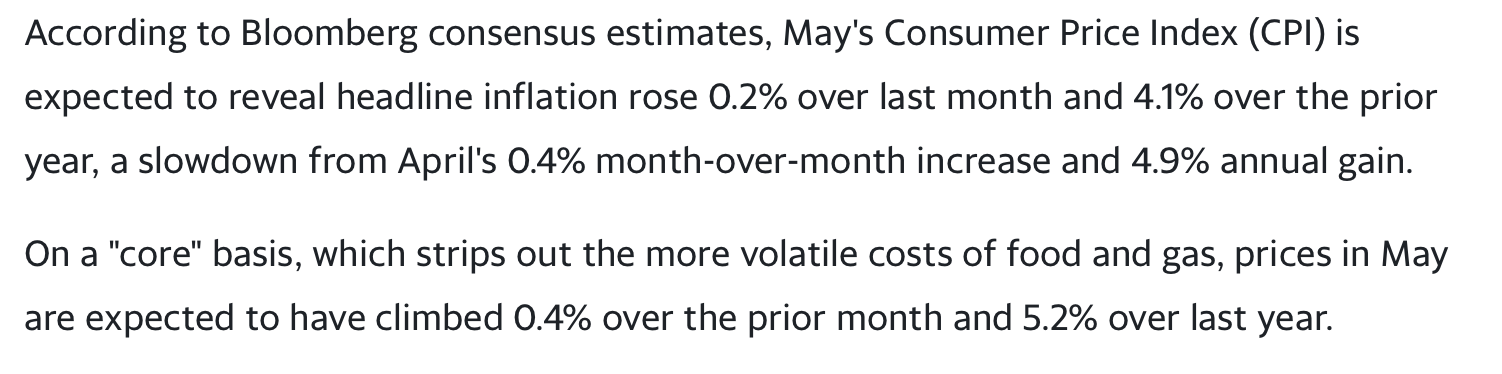

CPI comes in at 4.0%, YoY with 4.1% expected.

CPI MoM: 0.1%, expected 0.2%.

CPI core YoY 5.3%, expected 5.2%

CPI core MoM 0.4%, expected 0.4%