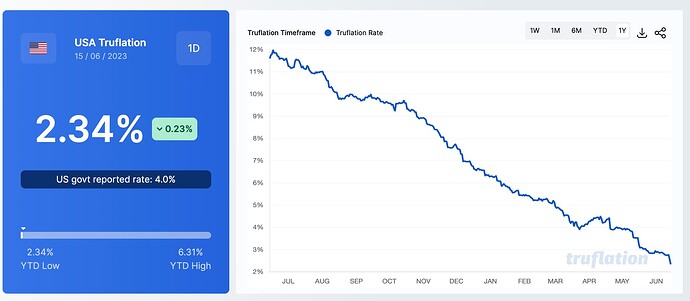

That’s a 90bps drop in the Yr/Yr rate vs last month. Not only is inflation decreasing but the rate of decrease is accelerating.

I don’t see much good news here(based on my readings from credible economists).

How is it not good that inflation is dropping?

Apparently we need 50 bps increase.

The earlier assumption was the Bank issues have dampened the inflation pressures, however 2 factors /indicators show that it hasn’t. They are:

- Elevated Job numbers

- Inflation numbers, specifically core.

Again I’m just reporting other credible professional people who have been consistently right.

We are 5 or 6 increases behind from feeling the full impact. I don’t get how they can say that. This feed back control system has a ton of lag. Even the rent number they are using to say core is high has a ton of lag.

Fed got burned last time when it said “transitory” inflation. Let’s see if they’re right this time about inflation if they stop rate increase.

Kris Patel, a popular social media influencer, is bearish of the stock market and argue that Fed would hike rate 2mrw. Refer to his reasoning below…

I expect the Fed to “skip”. Not technically a pause. They will say something like “we are skipping this one but remain data dependent. We can still hike in July. So don’t get too carried away.” Something like that.

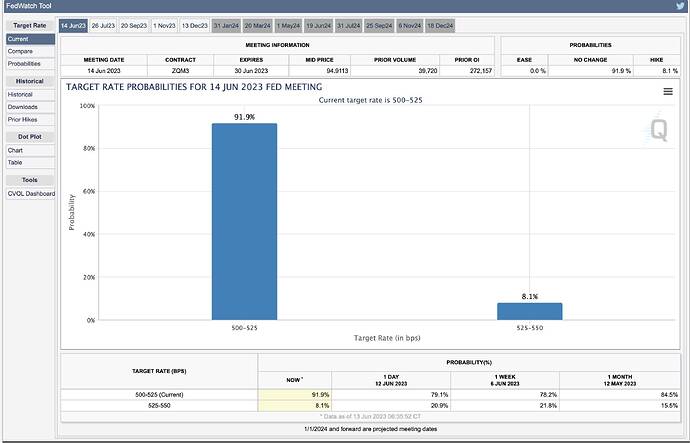

Why? Because the market is pricing in a 92% probability of skip:

The modern Fed doesn’t like to surprise the market. They see what the market has been expecting. If that doesn’t align with what they will do, you will see plenty of Fed officials hitting the media doing interviews and speeches to correct the market expectation.

So far we haven’t seen any of that. Instead we have seen multiple officials signaling a skip. And that’s what the market has picked up on.

Of course I could be wrong tho. If so I am in the 92% majority. Plenty of people with money on the line will be wrong with me.

How many months ago was this discussed here?

I have been saying the same for many months. Finally mainstream media is waking up to the fact that Larry Summers’ predictions have been grabage.

From his newly elevated platform in June 2022, Summers delivered another prophecy of woe. During remarks before the London School of Economics, Summers declared that “we need five years of unemployment above 5 percent to contain inflation — in other words, we need two years of 7.5 percent unemployment or five years of 6 percent unemployment or one year of 10 percent unemployment.” In the Harvard professor’s estimation, U.S. policymakers had no choice but to deliberately throw millions of Americans out of work or else accept a steadily deepening inflationary crisis.

It is now clear that Summers was wrong.

Unemployment rate at decades low. Prime age labor participation at decades high. And inflation has been falling faster than it has risen.

This guy is an embarrassment.

Going to the grocery store or gas pumps and you can see inflation abating. Gas in Carson City. $3.88. NY steak at KP international $5.99/#. Bacon at Safeway $2.97/#.

The Fed needs to go to supermarkets and gas stations. In fact all they need to do is look at gas buddy and supermarkets flyers…

Rents are down in Oakland about 10%. Down in Tahoe too.

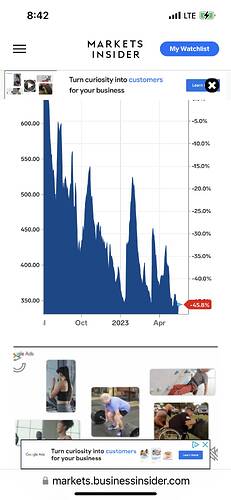

Lumber down from $1700/thousand bf to $344.

No sign of inflation abatement in Payson. Gas is $3.89, down from 4.09, but it had been down to $3.29 last November. No grocery items I buy have gotten cheaper. Bread has stopped rising but hasn’t come down any. Melamine, glass and acrylic seem to be the latest victims of the rolling inflation. Some ammo, like 44-40, now sells as high as $140 for a box of 50. Even night crawlers for fishing are up 10% to $5 box. New vehicles - only for the rich. Even used vehicles are beyond many budgets. People who might have bought used cars are now waiting on new engines for their 25 year old cars.

Remember inflation = rate of appreciation, not absolute price level.

This is deflation.

Not if it was $3.29 last year.

Didn’t want to respond to the Intelligencer article about Larry Summers, but here you go. The guy who has written the article has a Bachelor’s and Masters degree in creative writing. There should be some shame really by both the publication and the writer.

You have a degree in economics?

Sorry Degree in Creative writing and Masters in Fiction writing. What a joke! Embarrassing