I guess some people have a REALLY low bar. They think being less terrible is good and forget when things were actually better. I can see how that’d make certain things more tolerable.

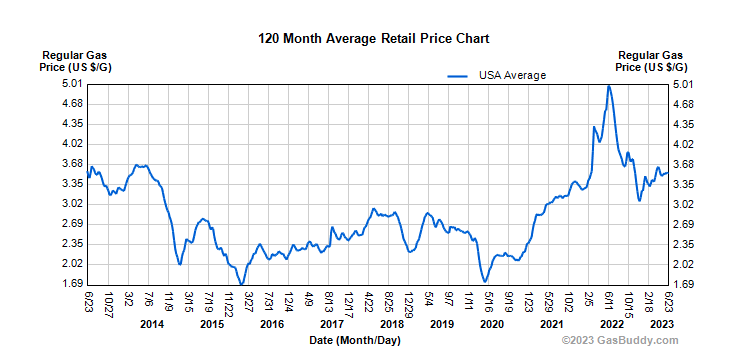

The same people who freaked out over a bit of inflation are pooh-poohing a 30% drop in gas price in a year? Why are these folks always so gloomy?

Anyway, zooming out a bit:

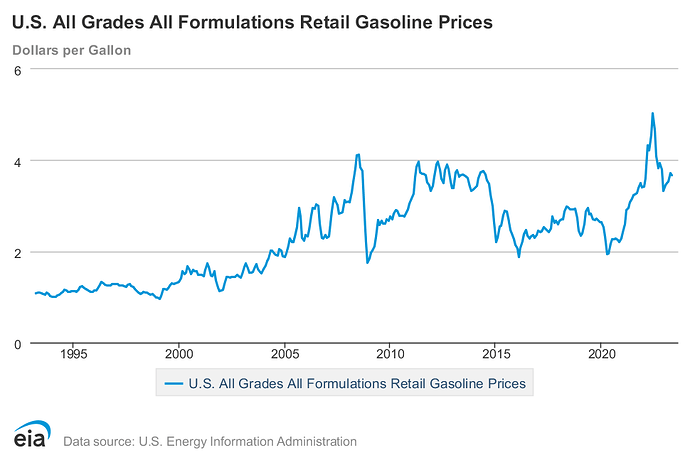

Gas price is back to 2008 level. How much purchasing power did the dollar lose in the last 15 years? Gas price today is actually not that bad.

And we are not done yet. Gas price has more downside to come, especially as EV continues to scale.

An alternative to Fed rate increases.

Much worse for the economy though. But it just goes to show how times have changed.

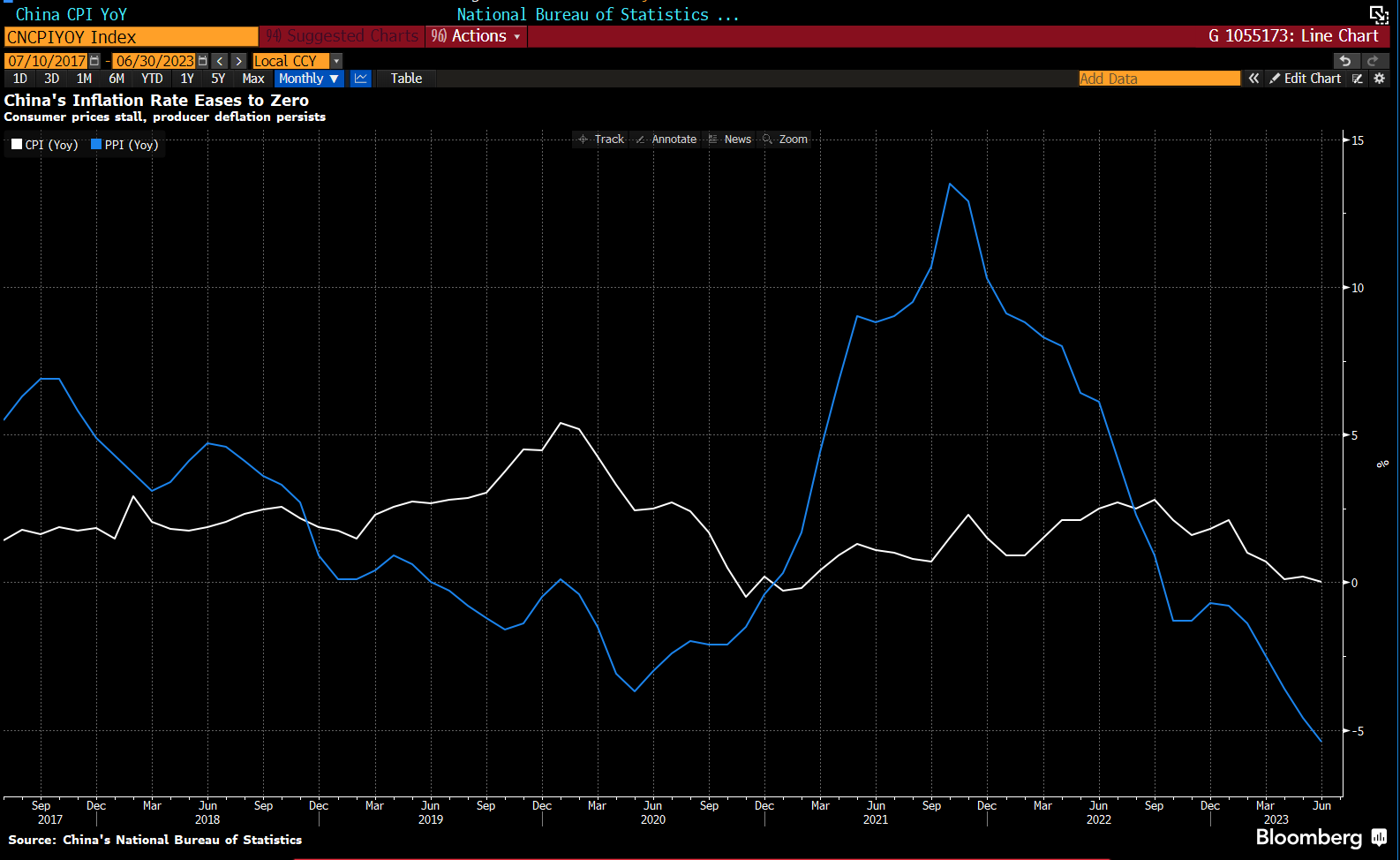

Outright deflation.

The Dallas Fed’s manufacturing release shows that factories are now cutting prices.

PCE, yoy: 3.8%, expected 4.6%

PCE, mom: 0.1%

Core PCE, yoy: 4.6%, expected 4.7%

Core PCE, mom: 0.3%

Meanwhile Swiss cheese is up about 40% in the last two months. I thought it might just be the brand I’m used to buying but no; it seems to be all of them.

For some reason JPow still wants to do at least one more hike. So even though I don’t think the data says we need to be worried about inflation the Fed is still hell bent on hiking.

![]()

Now CEOs with weak revenue will need a new excuse other than supply chain issues. This should also ease inflation pressures.

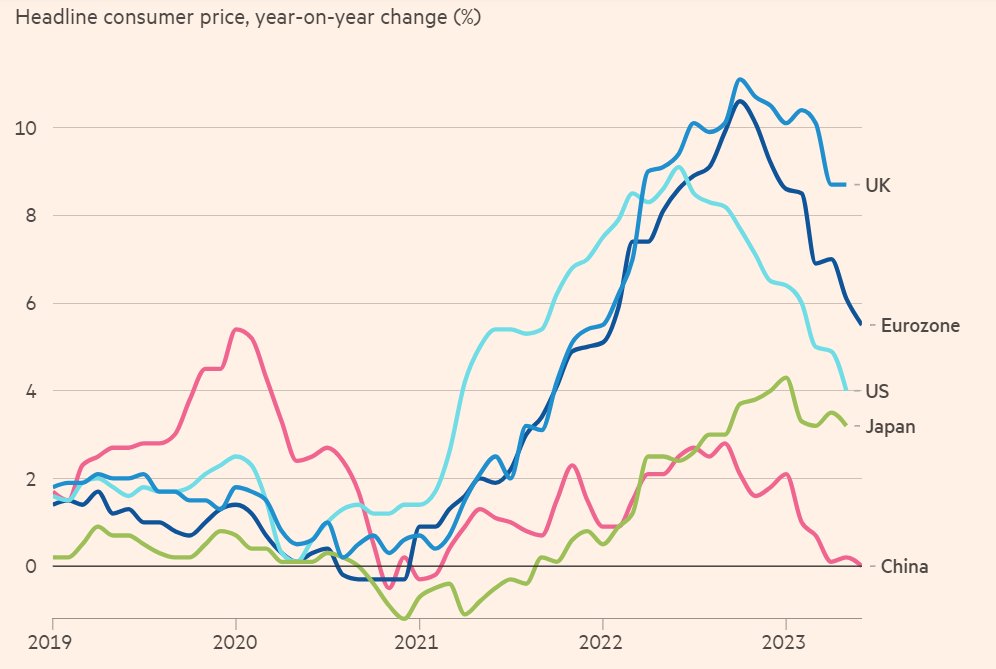

China is deeper into outright deflation. PPI is negative 5% and CPI at zero.

Don’t understand why Xi refused to do any stimulus. It’s like he doesn’t understand the danger or doesn’t care. I still remember how scary it was back in the GFC days when the risk of stuck in Japan style deflation spiral was very real. And China is already there and … does nothing.

Looking from outside is just an Armchair view

Looks like a July hike of 25 bps is a done deal. Fed officials are out doing speeches and interviews to prep the market.

Apartments ![]() Guess no data on SFHs.

Guess no data on SFHs.

No inflation, no deflation, is not good?

China is a developing country. Its per capita GDP is only 1/6 of America’s. It’s supposed to grow fast and thus has higher inflation rate.

It’s like a teenager is supposed to have higher metabolism than 60 year olds.

I used to think China can kick the can on its long term problems further down the road. Did not expect it to just stop making an effort. The long predicted collapse of Chinese economy is finally within sight.

When people are fearful, we should be greedy.

Time to buy some China stocks.

The unspoken assumption is that long term prospect is still intact, that the dip is only cyclical and temporary.

Doesn’t work if secular trend flips to the downside.

Imagine you lived in Shanghai in 1945. If you bet on Chiang thinking the Nationalists’ problems were only temporary you’d end up losing everything.

Let us know when you buy and what you buy.

Faster GDP growth doesn’t imply higher inflation. Some of the fastest growth periods in US history happened in an environment of falling inflation. And we’ve had stagnation with high inflation.