And we’ve become so hyper-regulated it’s harder and harder for restaurants to give their excess away to the needy. Same for supermarkets. Nothing wrong with food a few days past it’s “best by” date. Still safer that what 2/3 of the world eats.

Unrealistic Aesthetic Standards

When you’re in the produce aisle at your local supermarket, do you ever put back carrots, potatoes, zucchinis, or any other fruit or vegetable because it doesn’t look as straight, slender, round, or otherwise how we have been conditioned to believe this item should look?

Food waste in America is exacerbated by unrealistic aesthetic standards for our produce. You’re not alone in not picking up that misshapen carrot in the produce aisle. Grocery stores have learned over time that consumers don’t tend to purchase misshapen produce. As a result, many stores stop accepting them from their suppliers. Thankfully there are outlets for misshapen produce; restaurants don’t care what their carrots look like so long as they can turn them into delicious dishes on the plate, and start-ups such as Imperfect Foods, Misfits Market, and Hungry Harvest make it easy for consumers to receive “ugly produce” right to their door.

Exact reason why I have been using Imperfect foods for the past 2 yrs and it’s great.

I use them too. They don’t have everything, but I can cover about 70% with them.

yes I agree.

Commodities are crashing. I’m guessing the record wholesale inventory levels have led to a significant decreases in product orders.

Factory orders are dropping 20-30%.

“For other sectors like garments, sporting goods, and e-commerce, we are still seeing strong demand,” Nair said. “Major garments and shoes have not shown major declines or postponement in orders yet to my knowledge,” he added.

It is definitely impacting categories differently. They mention appliances have seen a big drop. I’m not surprised, since I’ve seen Home Depot and Lowe’s both run appliance sales recently. The home depot by me has inventory stacked to the top of the shelves. I’ve never seen the shelves stacked all the way to the top in every aisle.

Also, 0% auto finance and cash back incentives are appearing again.

U.S. Port Backups Are Extending Into Freight Rail Supply Chains

The congestion is raising costs and adding complications for importers managing the flow of goods in a fragile U.S. economy

It’s a HUGE mess now. Retailers and warehouses don’t have space, so they can’t pickup containers of product. There’s going to be some heavy discounting required to move product and open up space.

Owner-equivalent rent is 1/3 of the CPI… enjoy the circle of hiking fed rate causes rent to increase which cause CPI to increase which cause fed to raise rate… ![]()

Macron caught on tape telling a zombified Biden that the US needs to produce more oil. Never thought we’d need the French to tell us what to do.

Stay home and watch tv

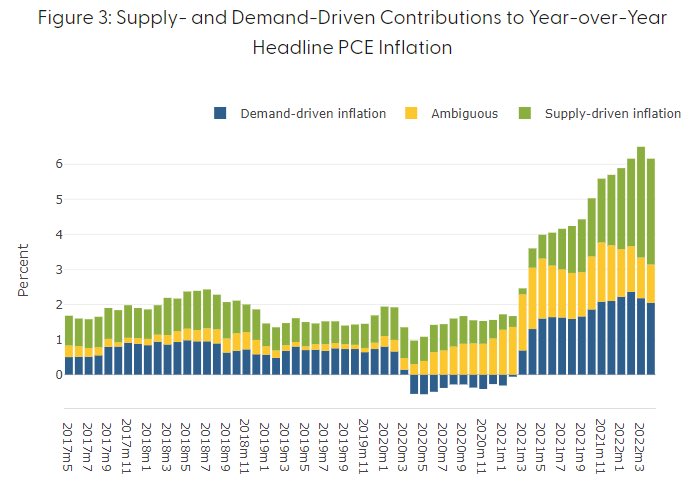

Looks like PCE inflation is trending lower, which sounds like a good sign. PCE is based on Fisher Price Index, which is geometric average between Laspeyres and Paasche. Reading below on the math, looks like Paasche uses quantities during the observation period, which may have fallen down due demand reduction (such as the gasoline) => Fed may see this as positive that rate hikes are working, inflation is going in the right direction. Next month most likely will be 0.5 bps, and if this gets released this Thursday, we can expect some shoot-up in Stocks…

So wordy, no chart.

Only thing need to know.

Don’t read the news – headlines are all over the place. Just look at the data that feeds into FED decision and then pre-fetch. Any gurus here have links to those / release timelines? We can then use that for some favorable trades & understand the pump / dump.