I think it’s becoming obvious what happened. Covid shifted consumer demand and created a significant increase in demand for some items. Companies thought this was the “new normal”, and there were legitimate supply chain shortages. Supply chains never caught up to the “new normal”, and companies kept ordering assuming it would continue. Now they are realizing it’s not a “new normal”, and the demand was a temporary surge. This is going to unwind inflation as companies have to discount excess inventory and reduce factory orders.

Commodities are in free fall. It will take time before that works through to consumer prices. However, they’ll have to start discounting existing inventory, since it’s at record levels.

This is what Cathie Wood predicted last year and people ridiculed her mercilessly for it. Now it has become conventional wisdom.

Inflation is not “secular” after all.

The wage increase portion of it is secular. I doubt wages are going to suddenly drop back to pre-covid levels.

Inflation is calculated as rate of increases over last year’s level. Wage doesn’t have to drop. It just have to stop increasing as fast.

Time to upgrade to the latest and most powerful ![]() GPU

GPU

CEO IB said inflation is secular.

Inflation started way before Russia even thought about invading Ukraine. It was over 5% in July of last year. There’s a nice graph in the article. It started to increase as soon as Biden took office and got the $1.9T stimulus plan passed. Who could have guessed that throwing a $1.9T stimulus into an economy with 4.0% real GDP growth in Q4 2020 would cause inflation?

I think this should thoroughly debunk MMT which anyone with an elementary understanding of economics knew was BS.

The Federal Reserve “lost its way” last year as inflation gripped American households and still isn’t being realistic about the impact it will have on the economy, ex-Treasury Secretary Larry Summers warned on Friday.

“In 2021, our central bank let us down quite badly,” Summers told Bloomberg. “As a consequence, they find themselves in a very, very difficult position, not least because they don’t have the credibility that they once enjoyed given their repeated poor forecasting record.”

“I have to say that it’s not something that’s been fully fixed,” Summers added.

Summers said the Fed’s “dot plot” projecting inflation would return to its 2% target and 4.1% for unemployment by 2024 was “highly implausible” and suggestive of “highly problematic groupthink” at the central bank.

Summers, a former top adviser to Democratic Presidents Bill Clinton and Barack Obama, has argued that higher unemployment is an unavoidable consequence of the policy tightening the Fed must enact to address inflation – meaning millions of Americans are likely to lose their jobs.

Summers added that he felt the Fed lost focus last year, ignoring its core mission of maintaining price stability in favor of other projects that weren’t central to its responsibilities.

“It was talking about the environment, it was talking about social justice in a range of things, it was confidently dismissing concerns about inflation as transitory and it made mistakes in the core function of a central bank, including leaning into highly expansive fiscal policies rather than accommodating them,” Summers said.

I’m not 100% convinced about high unemployment. There’s still so many more jobs open than unemployed. Even if half the open jobs were taken away, there’d still be enough to keep unemployment low.

I think the post 2008 period will be studied by economists the way the Great Depression was. They kept rates low and QE in place for a LONG time, because inflation was low. They didn’t feel pressure to act. They should have been gradually acting. The inaction was compressing a spring. The longer they didn’t act the more compression. Then once inflation started the spring was released. Throw a $1.9T stimulus on it and boom.

The recent bout of inflation is a global phenomenon. This is a chart comparing inflation rate of Q1 2020 and Q1 2022 worldwide:

So Biden’s 1.9T stimulus is so powerful that it sets the whole world on fire?

Now that the commodities are crashing hard and retailers busy cutting prices to offload inventory, it seems to me there’s really nothing to fear about this inflation bump. It will work itself out just fine without the Fed shooting the economy in its head. Companies over-reacted by bidding up prices of goods and labor, and they will correct by cutting back on both. Price will settle down and there is nothing to worry about. Summers is just still pissed he didn’t get any senior admin post. Read what he wrote during and after GFC and he’s been consistently wrong.

You’re super power is clearly finding graphs that are intentionally misleading.

Israel’s inflation rate is still less than half the US rate. 4.4% vs our 9.1%.

It’s better to compare a country against itself in determining how bad or how good things have progressed. Anyway, if Israel is not your cup of tea, how about Greece? 12.1%.

Spain at 10.2%:

https://www.aa.com.tr/en/economy/spains-annual-inflation-rate-hits-37-year-high/2625538

Fact of the matter is that inflation has turned markedly higher in most of the world.

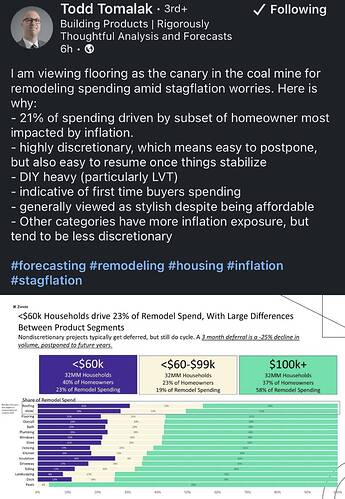

Can someone please explain what does this flooring percentage indicate? Slowing spending (recession)?

Lower income countries where food and energy will have a HUGE impact as a percent of total consumer spending. Just look at Greece’s 12.1%. Energy was 25%, and food was 12.6%. Everything else increased by less than the 12.1% overall number. Which 2 commodities are most impacted by Ukraine? Spoiler alert: food and energy.

Food and energy have turned higher since Ukraine invasion, but US inflation was already increasing before that.

My understanding is out of total spending on flooring remodel which is also not mandatory, 21% is by lower income people who are the most affected and might increase inflation more.