Basics of investment:

I buy a condo 500k, get 3000 rent/monyh expenses $1000/month, hold for 20 years, sell it for 1.5M.

The investment gains 1M + (2000 x 12 x 20=480k) = 1.48k. When we buy property, we are focusing future, not the past.

If condo is going to depreciated to from $500k to 100k, no one will buy that condo !

Exactly like this, fundamental analysis of Tesla, the whole world of big analysts group, should have properly accounted for next 20 years. This is where they fail. If they account only last qtr (after results), they are running behind FOMO or shortsighted.

Elon Musk did not magically turn the figure in a single day, it was accumulated over a period of past 10 years which investor community failed to foresee.

This is what I was telling mispriced by investor community. Warren Buffet is famous to find such misprice issues and buy those at right price.

24.6 billion in 2019 vs 21.4 billion in 2018. But this is not that useful without context.

#1 in last half of 2018 the full value of the federal tax credit was going to halve, and you combine that with a waitlist of people for 2 years wanting to buy their Model 3’s, Tesla was able to sell the higher end models way more than would be expected in normal conditions. And everyone knew that. So revenue in 2018 is essentially inflated a bit by those factors.

#2 Growth is not some simple linear process. It happens when production rate increases of current models or new models / lines come up and running. Not much of that changed between 2018 ad 2019.

However in 2020, we have Shanghai factory up and running producing Model 3’s, and Model Y’s being produced in Fremont (already). Before end of the year there should be Model Y’s produced in Shanghai as well.

So Tesla should have very strong revenue growth this year. And the margins should be pretty good on Model Y and Shanghai Model 3.

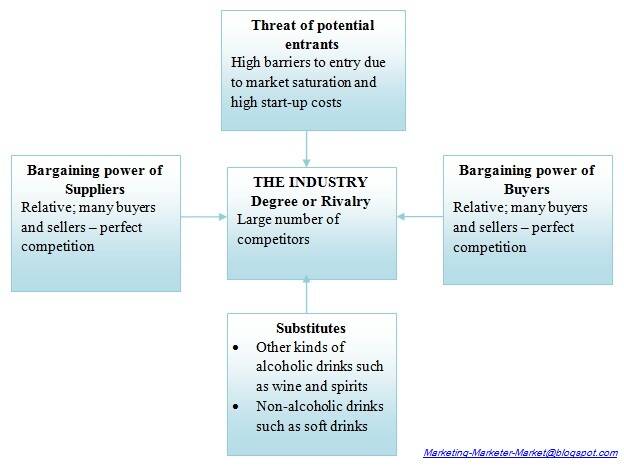

Dear Experts, can you break up the TESLA macro environment for me using the Porters Model for industrial analysis?

Basically, to understand TESLA’s future, we need to understand these forces:

How will the future revenues of TESLA be safe and guaranteed ?

-

Threat of competition ( barrier to entry is low in my opinion )

-

Bargaining power of suppliers ( auto industry is hardly made by one person 70% of auto is build by someone else). The supplier of battery will be the key differentiator.

-

Bargaining power of buyers ( excludes the snobs and the fan buyers )

-

Threat of substitute ( is a flying car coming soon to stores near you?). The $7000 used gasoline car works fine for me.

- Threat of competition - If EV got less parts, should be easy to make.

- Bargaining power of suppliers - So many of them. Battery? Don’t need that good. Short trips.

- Bargaining power of buyers - So many EVs, buy the cheapest, no need sporty look.

- Threat of substitute - Waiting for Apple Car else stick with Toyota/Lexus super reliable car.

Threat of competition - Not easy to make as efficiently as Tesla for a few reasons. Frankly has been discussed before so don’t want to get into detail, but it has been proven out as the competition can’t make their cars as efficient as Teslas and they are more expensive. Won’t change for a while

Bargaining power of suppliers - Not a problem for Tesla as they are much more vertically integrated than others. Battery is the big one but they are going to vertically integrate that more as well. Meanwhile, competition is having a heck of a time getting batteries. (seriously is this underestimated as an issue).

Buyers - Tesla is top brand with Porsche, not a problem.

Substitute - Big threat would be if someone comes up with Autonomous solution vs, and joins with other car manufature to make robotaxis. Even if not as efficient as Tesla, will dominate profits in market.

Tesla claims Shanghai was running at an annualized rate of 150,000/yr in Q4. That should have caused a revenue increase bigger than 2% yr/yr. That’s why I’m skeptical of a large revenue increase in 2020. They also need to offset the model S and X sales which are falling off a cliff.

Model Y should be a favorable mix shift. It’s made on the same line as the model 3 though, so it’s not a capacity increase for Fremont.

Shanghai is the potential driver of revenue growth. Who knows what the financial arrangement is for that factory. The sales from it don’t appear to be moving revenue as much as they should.

GM generates 6x more cash flow than Tesla per quarter. Yet, Tesla’s market cap is 3x higher. That doesn’t make a lot of sense unless Tesla is rapidly growing and certain to pass GM in cash flow. They were close to Toyota’s market cap before today’s drop. Toyota’s cash flow is 13x higher. Toyota is selling 10M cars a year plus their industrial business.

How long will it take Tesla to reach those sales and cash flow numbers? It’s worth paying for them today in the current stock price?

Huh? Shanghai factory just started producing cars near end of Q4. 15 cars were delivered, lol. No contribution to 2019 essentially. As expected. In fact the factory is up an running earlier than expected,

Model S and X sales are stable now.

Unclear if total Y/3 production will increase, or simply offset lower ASP 3’s for expensive Y’s. I think they still claimed to get to 10,000 / week total.

Total production rate to be achieved by the end of 2020 (in Q4 report) is at 800,000 vehicles per year.

Essentially twice that at end of 2019. Rate of revenue accrual will not double, but should be 50-70% higher than at end of 2019.

https://ir.tesla.com/static-files/b3cf7f5e-546a-4a65-9888-c928b914b529

Model S/X aren’t stable. They are declining yr/yr. That’s why revenue was barely higher despite delivering more cars. ASP is lower due to higher model 3 mix.

The table says current installed capacity in Shanghai is 150,000 cars a year.

That still doesn’t address their valuation is close to Toyota’s at a much lower cash flow.

Kids…

Students? Instead of spending on books and tuition, buy TSLA?

Instead of buying Apple shares, they bought Tesla shares.

Like what @marcus335 has been saying!!

Musk Needs Apple’s Margins and VW’s Sales to Justify Tesla Value

Math. It’s a thing. I should just start putting 5 P&Ls side-by-side and let people guess the companies and what the valuation should be. I’m pretty sure most people would be shocked.

I don’t have a horse in this race but it sure is entertaining to watch.

Model SX dropped last Q1, then went up and is stable last 3 quarters.

Your analysis ignored the massive growth ahead. Stock value is like average of probability distribution of future potential cash flows.

For Tesla, this distribution is massive. One could argue that Tesla could have 100 billion in revenue in automotive, energy, and autonomous driving per year in 10 years. How absurd you think that is will be dependent on how much you know in detail about the company and competitors.

If you just look at current financials, of course it is overvalued.