Some day, some one will hit that jackpot , who knows, but it is not easy work. This is kind of Einstein’s work.

Top investor Paul Meeks shares his take — and reveals why what he is buying Tesla gets more interesting to me at around $600 or $700… [it] makes a little more sense [fundamentally]That said. Meeks said that from a technical analysis perspective, charts also indicate that a breakout — when a stock moves in a sustained fashion past a certain point — may be on the cards.

Sound like Paul didn’t buy any below $700, is obvious buy.

Why is $700 an obvious buy, but $900 is not?

I don’t have any TSLA and don’t plan to buy any. But if someone thinks the stock will double or triple, does that $200 delta really matter? If they don’t think TSLA has that kind of upside, why bother buying even at $700?

.

Obvious answer.

May I know What do you mean by obvious answer?

.

Say, you have $700k.

At $700, then 3x, you turn $700k to $2.1M.

At $900, then $$2100, you turn $700k to $1.63M.

Absolute difference, $466,666k. Percentage difference, 22.2%.

2nd part is not answerable without stating a duration, S&P can achieve that easily in 8-15 years.

This is the way, every investor must approach stock buying. This is comparative analysis.

You have done this with thumb rule, others do using excel nearest to reality for their profit or ROI

In short, this is starting point of fundamental analysis.

.

I don’t use Excel, what is it? I use Numbers ![]() . I use to do detailed financial analysis (past, projections, what ifs) of AAPL, quickly become tedious data entry task, toil for about 15-20 years. Also TA, EW and option analysis. Can’t be bother anymore.

. I use to do detailed financial analysis (past, projections, what ifs) of AAPL, quickly become tedious data entry task, toil for about 15-20 years. Also TA, EW and option analysis. Can’t be bother anymore.

The upside of Tsla could be 10x from here. So at $600 was a definite buy. At current price is a buy. When it goes up to $2000 is still a buy.

A hidden assumption you have is that at the current price of $900, by waiting you can get the lower price of $700 in the future.

We can’t do time travel. The decision is always whether we buy it today or not.

I can also say TSLA is an obvious buy at $100. That’s pretty meaningless. What is the chance it will reach $100?

If you believe TSLA will go to $2100 in short order, $900 is a good entry point. If not then why bother waiting for $700?

My question to Paul is why didn’t he bought when TSLA was trading below $700. And why now want to wait for TSLA to drop to $700.

Cut n paste previous post for easy reference.

We can’t do time travel =>

There is a true workable concept about Efficient Market. Long term, say more than year outlook, market matches the value of the company.

Short term, market fluctuates based on various conditions including demand and supply. We have practically seen any company fluctuates within certain range. The long term mid-point SMA200 is almost equal to company value (This is theory). Investors deep dive on fundamentals (many companies pay $250k/year for such analysts), arrive at a company value figure, wait for opportunity and buy it at dip.

This is exactly being practiced by warren buffet, waiting for years, before he dips at rock bottom. He is not rolling back years, but waiting like a crane. When so many people blogged last 3-5 years WB is keeping high cash, he never bothers.

He just took a sweep shot last 3 months investing more than 50B from cash to stocks.

Compare his last five years with last 3 months investment.

This way he gets highest return which no others (most) are unable to beat.

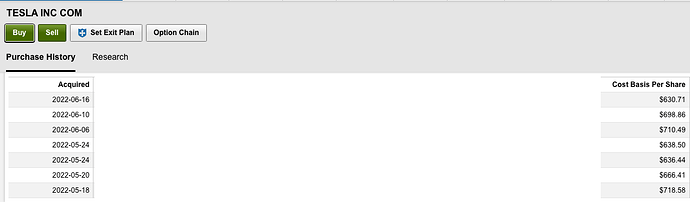

Even here, just count when WQJ purchased TSLA last two years, he monitors carefully and bought it at deep bottom price.

When someone calculates ahead and wait for deep bottom, his ROI is too high, but it involves timing and monitoring.

.

Just to add one point. WB is monitoring a handful of potentials, not fixated on only one stock. Whichever come first, he buys.

As to why he likes AAPL so much is because of high free cash flow (about 4%). WB loves valuation using DCF. I think he doesn’t think in terms of high growth rate of revenue, earning, P/S and P/E. I might be wrong ![]() about WB’s thinking.

about WB’s thinking.

True quality of investor, open minded to view many and pick the best. If investor is fixated with a stock, he/she is biased.

True, with his high money, safety (against loss) is important, he chooses value based stocks.

Regarding growth stock, the current valuation includes future growth, which he does not like and no one guarantee future growth. For growth stocks P/E does not reflect correct picture as P/E+PEG are accounted.

For example(Finviz) :

AAPL P/E = 28.59, EPS next 5Y 9.83% Current price $175.50 includes 9.83% growth

TSLA P/E = 110.39, EPS next 5Y 51.89% Current price $924.68 includes 51.89% growth

https://www.tesla.com/support/energy/tesla-virtual-power-plant-pge-2022

Become a part of the largest distributed battery in the world and help keep California’s energy clean and reliable. Opt-in to the Tesla Virtual Power Plant (VPP) with PG&E and your Powerwall will be dispatched when the grid needs emergency support. Through the Emergency Load Reduction Program (ELRP) pilot, you will receive $2 for every additional kWh your Powerwall delivers during an event. Adjust your Backup Reserve to set your contribution, while maintaining backup energy for outages.

Wow, Musk volunteers to help other EV makers? How nice…

The move is expected to happen by the end of the year and comes as opening the network is a requirement to get access to new federal funds to accelerate the deployment of EV charging stations.

Tesla’s mission is always to enable the world to use energy much more efficiently; it has never sought to monopolize or destroy competition.

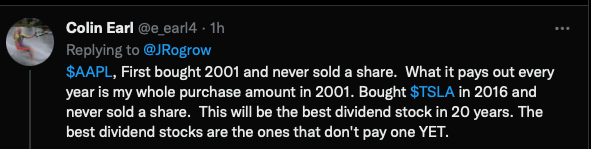

Is Colin Earl, a handle of @wuqijun ?

Anyway, EM did say would consider buy back and dividends once TSLA has the necessary free cashflow. Soon?

First off, all my Aapl stocks were given to me as stock options from when I worked there. I never bought a single share of aapl in the public market.

Secondly, I bought Tsla in 2012 and never sold a share, not in 2016 like this guy. Subtle difference ![]()