Truly speaking, the market valuation should be function earning capacity of underlying stocks, not how much free money is available in the market. But, we live in world of distorted reality.

discounted cash flow ![]() which changes with risk-free interest rate.

which changes with risk-free interest rate.

Since it bothers you, think quantity of free money expressed in f(risk-free interest rate).

Free money increases their earning potential. Most companies have revolving credit, bond debt, etc. lower rates means less interest expense which leads to higher earnings.

The word free in free money was not to suggest interest free money. By free money I just meant plain cash. Even if we assume the money is available interest free, there is limit on the valuation. Even if we assume a company has zero debt, still there is an limit on its value. Zero debt does not mean infinite valuation.

Well yes and no.

If cash yields nothing and the S&P yields a little under 2% do you really want to stay in cash hoping to catch the market bottom?

DT, HUBS, OKTA, PLAN, SHOP, SPLK, SQ, TEAM, TWLO, UI, WDAY, ZEN are GREEN.

The Russell is down by less than the S/D/N. I haven’t seen that in the near term, its moves tend to be bigger. No clue what it means.

XLF broke below the low on the 15th. If it’s leading us down it’s going to hurt.

Unfortunately, this will become potential issue for me. It may be 100% wrong at times. I do not want to mislead people, staying away from any daily updates.

Also, I do not trade on daily basis, once in some days, may be few times (less than 5) in a month.

It’s Tuesday. Buy TACO

Fed to pump more $$ into the market and WH to send more free $ to people, let’s rip

Fed to pump more $$ into the market and WH to send more free $ to people, let’s rip

Sound like your system didn’t issue a sell signal ![]() Cut off half UPRO position

Cut off half UPRO position ![]()

Multi decade bull

Good start

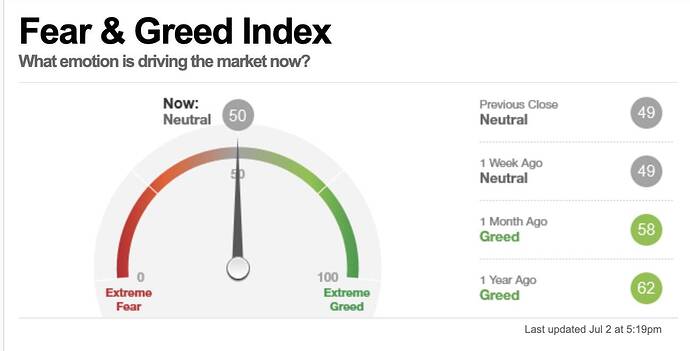

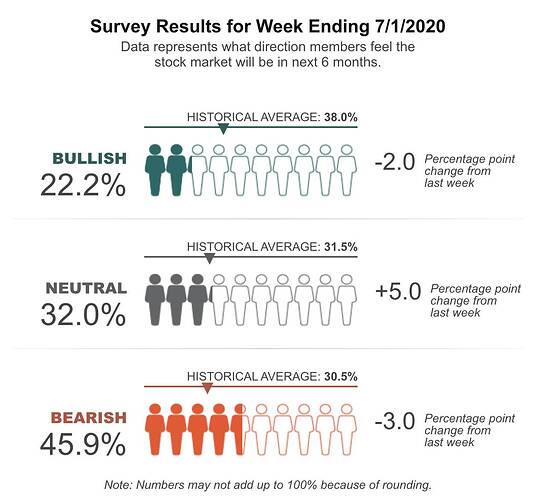

Sentiment check. Again, where is the bubble? More fear than greed.

https://www.isabelnet.com/wp-content/uploads/2019/10/BofA-Bull-Bear-Indicator.png

A bull market always start when the fundamentals are still deteriorating. By the time, fundamentals are obviously improving, market likely nearing and making ATH that is higher than pre-Covid ATH. Many WFH/ cloud stocks are already 30-50% higher than pre-Covid ATH.

If you believe @manch that less than 20% would go permanently remote/ WFH, these stocks might re-test the mid Mar BUT not break below. If you belong to @marcus335 camp, BTFD. Alternatively, nibbling traditional stocks that would recover once economy goes back to steady state.

Caveat: Not a forecast or a financial advice.