![]()

![]()

![]()

It is not easy to break the bull run as lot of people are just trading during bull run. Market was running exuberantly well with FED free money…

If I am able to get exact point of turn, I may be able to make good money, otherwise just sit idle with cash position !

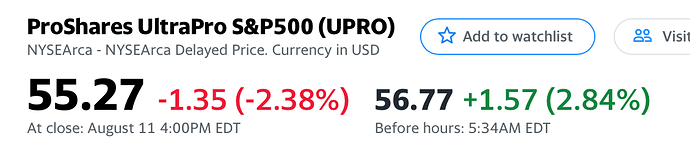

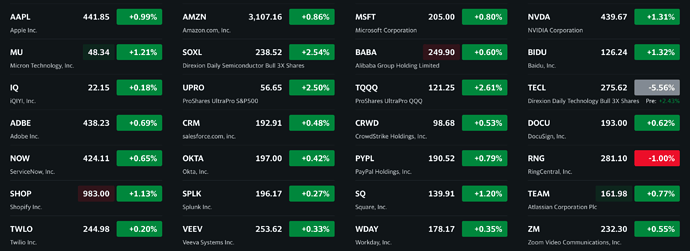

UPRO… UPRO… UPRO… 500 less tech stocks are gaining…

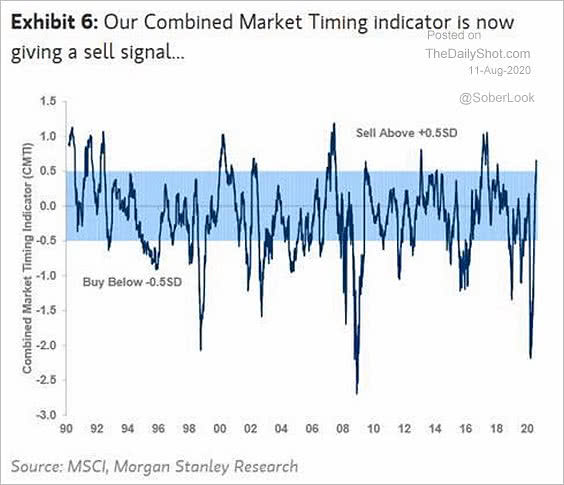

Talk but didn’t act. XLI shot up 10% already, didn’t seriously consider ![]() Matrix had made a change.

Matrix had made a change.

It’s sector rotation again. The last few times cloud stocks roar back once it ends.

Your thoughts?

You mean cloud stocks are not going to roar going forward?

Since you’re a millennial, your thought?

I don’t own any ad-supported business model stocks. Don’t want to support this kind of business model.

Btw, I am a buy n hold (hopefully forever) investor. Don’t presume a person talking a lot about an issue or issues mean very interested in those issues. Trading amount is an insignificant percentage of my portfolio - just for entertainment or mad money (as Jim Cramer said) i.e. willing to lose completely every dollar. Bulk of my stock portfolio is in AAPLs and S&P index funds - I hardly look at them.

No I am not a millennial.

I am a long term investor as well, 80% of the investment is on S&P 500 index and the other 20% is on FAANG.

None of us know, but trend says they will roar.

Not happy with parento ratio? In another thread, you say you are considering changing the ratio. No need to change ratio. Any ratio is arbitrary anyway.

Market is diving while we are talking. TSLA drops below $1400. Millennial-Robinhooders need to liquidate other stocks such as AAPLs to meet the margin calls.

Sell SAH and WFH stocks?

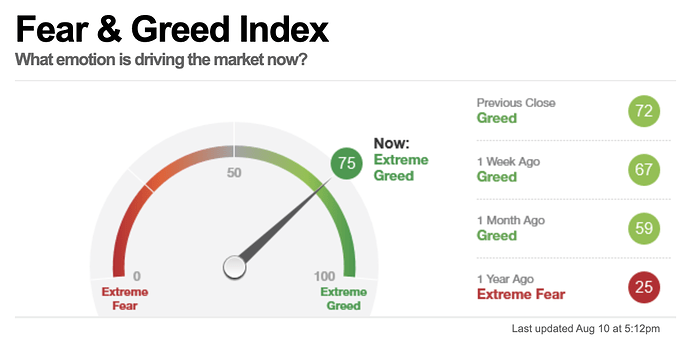

Actually it’s about time to sell a little, if you are the trading type. Not a fan of being too long when it hits extreme greed.

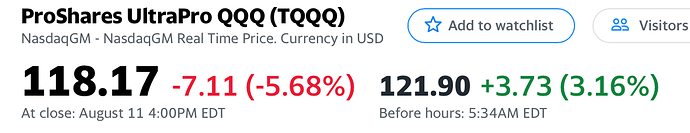

Huh? Since I started trading UPRO in late Jun, have bought and sold UPRO for 22 times, so far are green trades. Started TQQQ a few weeks ago, 10 trades, one red ![]()

Traders trade regardless of bull or bear or sideways market.

I thought Harris is too far left like a commie?

The big ‘surprise’ that could send stocks higher: Morning Brief

Cyclical sectors like financials, energy, materials, and industrials have been leading the market while tech high-flyers have been lagging since the Nasdaq’s record close on Thursday. Baird strategist Michael Antonelli also noted Tuesday that the equal-weighted S&P 500 has outperformed against the cap-weighted index for a month, suggesting a rotation has indeed already been underway. Albeit quietly.

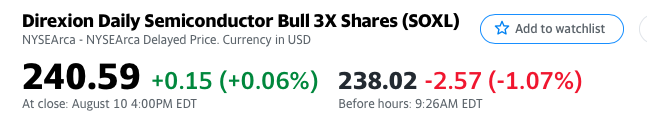

This is not a run-of-the-mill rotation. The decline in share price of some SAH and WFH could be quite severe. It means may have to switch from TQQQ to SQQQ.

All of the above are either after the fact or following market action misleading readers…etc. None are the real reason.

Most of the common investors believe this story and either Terrified yesterday evening or Bullified today morning.

You won’t believe it, Everything is FED money and run by computer algorithms of HFT make up. This creates FOMO in public. When everyone puts money, they will show the real face !

Many may feel that I am giving too much weight-age to computer or some nut kind of guy !

For the first time, I day traded yesterday, bought SPXU yesterday morning ($8.95) and sold evening (GTC auto sell at $9.29) resulting nice profit !

Remember one thing: Anything goes up without real growth will come down at some point later. This is the so called mean reversion, google it you will know.