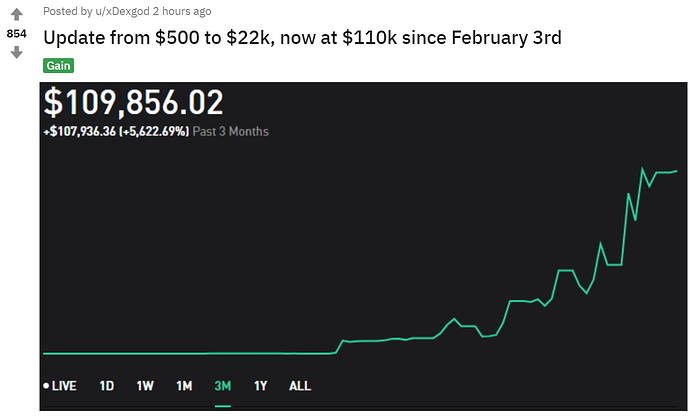

@hanera, you wanted big gain right, here you go, someone posted like this.

Fed is dumbass

FED has done more than enough, but that does not stop the market reaction, but reduced the drops from normal 10% to 2%. Otherwise, today would have been disaster.

Now, market has better resistance with FED in action…wait and see the situation in next 30 days, market must be up from current level.

This is again pure guess work, no invitation to buy or sell stocks.

I commented a few posts ago that the market should find its own real bottom assuming 0 Federal Intervention ( no taxed money, no printed money, etc) . I hope my wishes are coming true and this is the real bottom, not a one supported by FED. If it so happens, the US economy/stock market will be on firmer ground.

SAAS companies are outperforming. There’s an old saying don’t fight the fed. We all saw what happened when the fed did the rate increases then then did the rate cuts. Now we have rate cuts and as much QE as is necessary. This may not be the bottom, but it’s hard to go wrong when the fed is so active. Especially when we know they will avoid shocks to the market. They won’t increase rates until it’s priced into the market.

Normally, such recessionary period, FED creates unexpected announcements, mainly to preemptive actions.

There are multi-billionaires, hedge funds sitting on side lines will come forward and buy the stocks.

Watch now, VIX is also going down as the protective puts are getting reduced.

why PAYC is falling like a rock?

You know that I can not suggest anything for others…as it involves money.

I look for profit making and dividend companies only, exception TSLA, AMZN, GOOGL, TEVA. I purchased second lot of AAPL at $215 and TSLA $416, then T at $26.5 level, waiting further to DCA. My feeling is none of these will file bankruptcy in case of recession !

Recession/Correction period, everything falls/crashes without any reason, do not look for any proper reason.

TEVA?

The Fed is enlarging the bubble. Their behavior makes the market even more risky.

I trust Warren Buffet, until he holds TEVA, they are unlikely go bankrupt !

I want to buy more when dips, but TEVA is going up today.

The Fed is enlarging the bubble. Their behavior makes the market even more risky.

Don’t want to join in or just an academic comment?

The Fed is enlarging the bubble. Their behavior makes the market even more risky.

I felt the same when FED bought QE during 2008, but worked it nicely, hoping the same as they are well experienced folks to run that type of work.

2008 was different from now. With rates at historic lows for an extended period of time any further easing (with no limit) would further enlarge the corporate debt bubble to a point of no return. Fed is running out of ammunition.

The businesses should delink themselves from government and its agencies like FED and Treasury . As I suggested previously, they should have their own risk mitigation plan. If apple can have such a big pile of cash, and BKH can have pile of cash (almost 50%) , other companies should maintain a fund to cover at least six months of emergency. People are taught to do the same. Why can’t companies?

You know that I can not suggest anything for others…as it involves money.

I know ![]() Messing with you. I will sideline for awhile. I am ignoring what Fed and Trump are doing, I believe it won’t help the stock market - people are scared, very scared, only a promise of a vaccine/cure/therapy would calm the nerve - such news have to come from doctors and healthcare companies. I am waiting for GILD clinical trials - suppose to have a prelim outcome in mid-Apr. So I will patiently wait.

Messing with you. I will sideline for awhile. I am ignoring what Fed and Trump are doing, I believe it won’t help the stock market - people are scared, very scared, only a promise of a vaccine/cure/therapy would calm the nerve - such news have to come from doctors and healthcare companies. I am waiting for GILD clinical trials - suppose to have a prelim outcome in mid-Apr. So I will patiently wait.

This guy has insider knowledge of the GILD clinical trials?

Market can not go down and down, buying spy calls best option!