This week’s earnings calendar:

Harry Dent is the worst. Shameless bear who bankrupts everybody listening to him.

But please liquidates your AAPL shares on May 1st.

I am selling all my RE and buying Tesla, Bitcoin and Canopy Growth. These millennials know everything. How could I have possibly survived this long?

Me2

This article is interesting. What type are you? ![]()

I am not bragging, just complaining. I use antidotes to illustrate facts not to brag about my net worth.

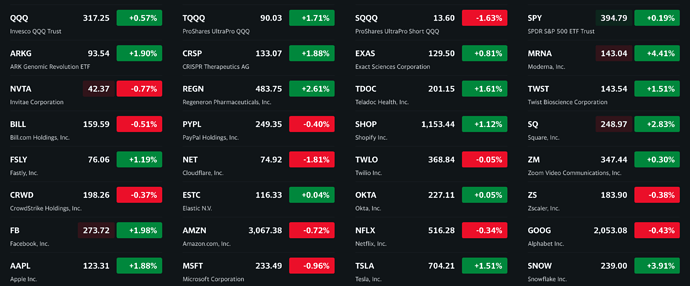

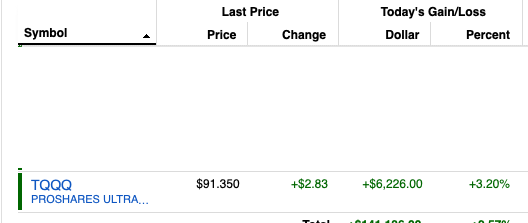

Yep, monster day in biotech for me today. I’ve loading up on DMTK, TMDX and SOXL+TQQQ. I was so deflated after bitcoin ripped on weekend and lost all gains (on bad banning news) but those DMTK and TMDX are paying off. I don’t know about TMDX but DMTK could pass the previous high easily. That’s my only 10x bagger that sits on both long and trading accounts.

https://www.cnn.com/2021/03/15/investing/cathie-wood-ark-invest-etfs/index.html

Take note…

The strategy of picking just a handful of potentially big winners is not for the faint of heart, as witnessed by the recent volatility in the funds. ARK Innovation, for example, has nearly half of the fund’s assets in its top 10 stocks.

…ARK’s decision to limit the number of stocks it owns. It’s more of a go-big-or-go-home approach. He describes Wood’s and the rest of the firm’s strategy as looking for companies that are an industries where “it’s winner takes most.”

Market roaring! Where is the bear? Still on vacation?

Many stocks are trading higher than yesterday’s close. The mega caps are dragging down the indices.

Edit: Indices are above yesterday’s close too.

GDP forecasts keep getting higher and higher. Wait until that gets reflected in corporate guidances for 2022 later this year.