Yep,

DIS, UPST, ABNB, FNGU, COIN, PYPL, SQ, U all getting closers to an oversold territory. I think this Dec rally might be a quick one so I might just reduce it to a very few and FNGU though.

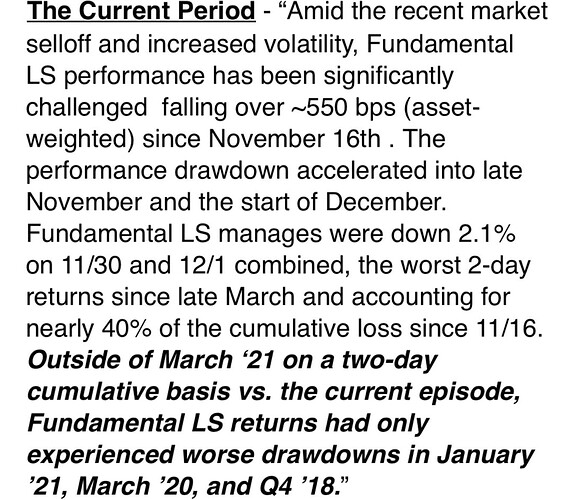

This dude is a hedge fund manager (few billion in assets) and a former GS. He’s made me a lot of money over the last year or so (he’s not always correct though) and he’s been pretty good for mid term predictions. I think he’s right, HFs might go on an extreme buying spree soon…

LS stands for?

Make sense. Was puzzled, how can stock market go down when 10-year Treasury yield is down.

Long Short

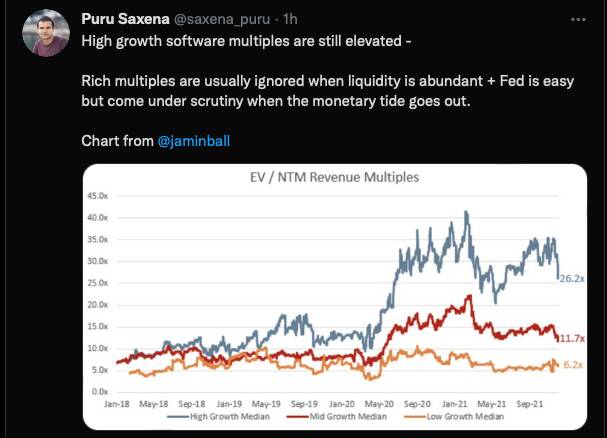

Well said about multiples. Mr Market might be very cruel to no earning stocks in 2022. Focus on growing revenue ignoring earning story may not work anymore. Is show me the money time.

Beautiful zigzag correction with yesterday’s SnapBack rally. I think more pain to come next week. Might be done for today though. Sitting on a lot of cash to btfd but need more red for me to go in heavy.

Watching SPX 4300-4390 as a time to add heavy.

Covered my spxu and sqqq for now though.

For those who have cash lying around…

So just wait like a crocodile but no afks or watching too much TV serials.

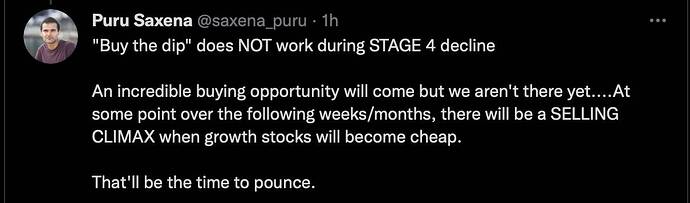

Hah yeah, stay patient. Indices still heading toward the lower end of RSI and big tech is just getting started. If big tech goes, much deeper correction imo. Many growth stocks are getting closer but big tech is still holding everything up. I’m expecting a pre-pandemic valuations for many of the stocks at some point. I still think a very strong rally will come in December.

Today is Dec 3. Still not in December?

I think some are there.

When is considered pre-pandemic? ZM and DOCU are pretty close.

Who knows but they are definitely oversold at this point. I still think they are very good transformative companies. I’m just afraid of big tech price levels. They are still at the top end of the RSI and about to head down in the momentum (AAPL, TSLA, NVDA, etc). Do they go deep or shallow? Maybe that will push down the growth even more.

I think it will have to be another 1-3 weeks for any good price action…too early for now.

We need Powell for a snapback rally. Where is he? Maybe he doesn’t care anymore since many of his friends are no longer in the game aggressively.

According to Puru, Powell will stop tapering when he thinks market has suffered sufficient pain. Do you know anyone close to him? AAPL MSFT GOOG are still strong, so Powell will not do anything yet.

Tapering tantrum is causing this uncertainty last few weeks. Imagine what rate change will do…it will be a psychotic breakdown.

Only good course of action is to HODL, and hope that stock indices like SPY, QQQ as well as crypto will again get to ATHs in 2023 if not in 2022, after Fed is done with its tapering and rate hikes.

In between, DCA buy if possible or stay quiet, but DO NOT SELL

.

He kept telling us that inflation is transitory and then he changed his tune after getting elected. So all along he knows inflation is not ![]() transitory.

transitory.

Work only for SPY, QQQ and FANGMANT. Not sure about some crypto coins and hyper growth (no earning) stocks. May not recover. DCA buying into those is suicidal… is like burning your hard-earned money.

SPY, QQQ and similar very broad stock index funds are 70% of my portfolio. In contrast, crypto is only 3%. So, I am comfortable HODLing.

Treasuries are up which means interest rates are down. 20-year treasury yield is 1.78% now. It was over 2% less than 2 weeks ago. This is panic. People are selling equities to buy treasuries. That’s the most illogical thing to do with inflation over 6% and the fed tapering and looking at rate hikes. People are valuing the safety of treasuries at this moment.

SPY dividend yield is 1.25%. Does anyone think over a 20-year period SPY will average 0.53% annual return?

It’s also irrational panic since even companies who’d benefit from another lockdown have dropped significantly. Those blind panic moments create the best buying opportunities.

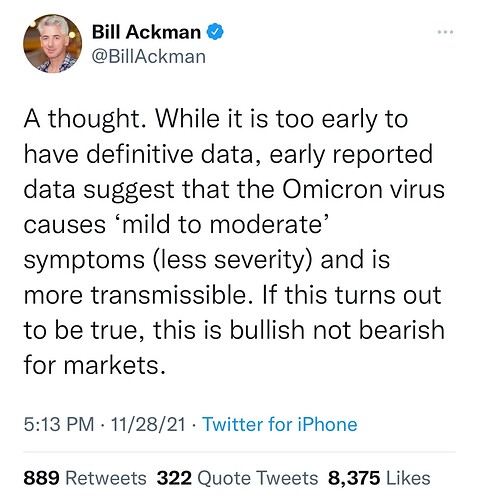

Bill Auckman reads my post?

3 days ago…

Repeat again 1 day ago…

Thinking aloud: Why is @manch posting what I have said when other said it?

.

So far, I have BTFD into SE UPST SQ. Now cursing NET and NVDA to deep dive.

Anyhoo, I don’t think is blind panic moments. Is pure Minsky moment that many growth stocks are over-extended and excessively overvalued. As I have said in other posts, need to be careful what you BTFD. Has to be high margin, high growth, good profitability… ROI stocks are risky.