I agree with JC that we should just let the young investors find their ways. Stop patronizing them.

Let them all loose massive amounts of money. The hard way is the only way to learn.

“An excerpt appeared in Value Investor Insight. Savor this:

Imagine if a friend had introduced you to Warren Buffett in 1972 and told you, “I’ve made a fortune investing with this Buffett guy over the past ten years, you must invest with him.” So you check out Warren Buffett and find that his investment vehicle, Berkshire Hathaway, had indeed been an outstanding performer, rising from about $8 in 1962 to $80 at the end of 1972. Impressed, you bought the stock at $80 on December 31, 1972. Three years later, on December 31, 1975, it was $38, a 53% drop over a period in which the S&P 500 was down only 14%. You might have dumped it in disgust at that point and never spoken to that friend again. Yet over the next year it rose from $38 to $94. By December 31, 1982 it was $775 and on its way to $223,615 today—a compounded annual return of 20.8% over the past 42 years.”

Excerpt From: Christopher W. Mayer. “100 Baggers.” Apple Books. 100 Baggers on Apple Books

AAPL is nearly a 700 bagger.

The new ones are:

$100k in U

$100k in PLTR

Put inside a coffee can for at least 15+ years. No trading. No hedging.

Have no feeling on PLTR. I agree with Beth. PLTR is too reliant on government contracts and therefore the culture and the org structure can’t compete in normal B2B sales. I have some U but it doesn’t give me a 100 bagger vibe. Hope I am wrong.

AAPL

MSFT

HD

Own them all

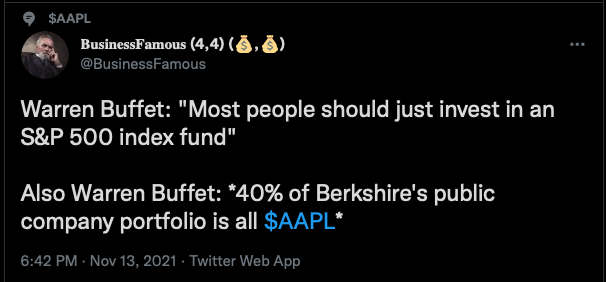

WB is in semi-retirement. Wealth preservation is more important than wealth growth. S&P index + dividend paying stocks like AAPL are ideal ![]() Some growth is

Some growth is ![]() and good growth is

and good growth is ![]()

Any new insights from an old man?

Long Apple ![]()

Wait, you knew that already!

Isn’t oil is dead because of EV🤔

![]()

BRK provides a good balance to a growth stock portfolio especially those investors who don’t like to hedge/short and/or go into cash now and then. Lower the beta yet has alpha.

Belatedly realizing this is true. Would’ve been a good place to park cash in the last one month.