wuqijun

October 31, 2018, 7:15pm

423

Not interested in knowing anything you own besides Aapl.

Jil

October 31, 2018, 7:36pm

424

Before this market was down, I sold some TEVA at 24 to 24.75 and now I bought same equal shares at 19-20 range. Since this is in retirement account, no tax implications. By doing this, I booked 100k profit.

That is why my YTD realized gain is high.

1 Like

hanera

October 31, 2018, 7:57pm

425

Actually I sold most of them to buy houses

2 Likes

manch

October 31, 2018, 8:01pm

426

Tech Drove Stocks Skyward. It’s a Different Story on the Way Down. - The New York Times

wuqijun

October 31, 2018, 8:23pm

427

Yes, houses are better bet for long term stability than Aapl.

1 Like

Jil

October 31, 2018, 8:40pm

428

hanera:

Incredible ! Of Course, worth sell AAPL to buy Cupertino (I guess) home !!

BAGB

October 31, 2018, 8:48pm

429

What? I don’t understand what you guys are talking about!

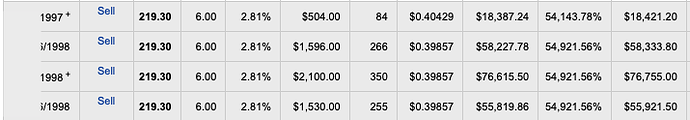

Did hanera sell most of his aapl in 1998 and 1999?

What does the column with 54,000% mean?

harriet

October 31, 2018, 8:51pm

430

He wasn’t even physically here yet to buy his fortresses in the late 90s.

BAGB

October 31, 2018, 8:51pm

431

He was buying his Singapore mansion

he bought in 97 and 98. the appreciation from purchase price ($0.40 split adjusted) is 54,000 percent

1 Like

BAGB

October 31, 2018, 9:12pm

433

Wow, stock is the way to wealth.

I hope he bought 7k shares in 1998, that’s only $40000. That would be 20M today.

If he used $40k to buy a Cupertino house in 1998, he might make $2M. So Aapl gave him 10x acceleration

1 Like

wuqijun

October 31, 2018, 9:44pm

434

Don’t get too excited. @hanera sacrificed 20 years of his life for this kind of gain. Where are you going to be in 20 years?

2 Likes

BAGB

October 31, 2018, 9:46pm

435

20 years of sacrifice on what? He bought 7000 shares and then forget about it. There is no scacrifice. Aapl shares provided him continued excitement so that he can survive the boring life

harriet

October 31, 2018, 9:46pm

436

Where were you in 1998?

Okay fine I guess down payment was not required back then.

BAGB

October 31, 2018, 9:48pm

438

I don’t see any company that’s going to be as good as aapl. So I’ll forget about stocks

$40k was the down payment for a 1998 Cupertino house with 10% down

hanera

October 31, 2018, 9:54pm

439

How can you say this when you didn’t do your due diligence? Just few years ago, you can buy FB, TSLA and NVDA on the cheap. Today, some of 10x stocks could give you those returns. Do DD, tell us which one you like.

BAGB

October 31, 2018, 9:56pm

440

But in 1998, no DD can reveal that aapl is going to rise 540 times.

Maybe just DCA on sp500 index and hope that dummie defeat smarties.

Or just buy houses and hope for a steady but smaller nest egg. Stability is another dimension we need to consider

1 Like

wuqijun

October 31, 2018, 10:00pm

441

You could’ve purchased your favorite tech stocks back in 1998. Could’ve been Apple, Msft, Intel, Cisco, Amzn, among others. Most would not give you 500x, but maybe one of them would.

1 Like

BAGB

October 31, 2018, 10:02pm

442

In 1998, no one would buy Aapl. Most people would buy msft, inc and CSCO. You can’t buy amzn since it’s not even public