hanera

July 19, 2018, 7:48am

1

Relevant links:

Asian economies, as defined by Unctad, will be larger than the rest of the world combined in 2020, for the first time since the 19th century

Asia’s recent surge, which began with Japan’s postwar economic surge, represents a return to a historical norm. Asia dominated the world economy for most of human history until the 19th century.

18th century to 20th century…

Then, for three centuries, Asia’s place in the world shrank as western economies took off, powered by what academics refer to as the Scientific Revolution, then the Enlightenment and the Industrial Revolution.

Because of China’s unique distribution and sales methods, car dealerships and salespeople make a high margin on each vehicle sale.

China’s drug distribution system is multi-phased: drugs pass through various tiers and expensive middlemen before arriving at hospitals and pharmacies.

Car salespeople and drug middlemen are vampires.

Next, China is home to rampant corruption. The national government is actively trying to stamp it out in an effort to make the country more business-friendly for westerners and to avoid the economic and business inefficiencies that come from corruption.

Corruption is so deep-rooted, can it ever be solved? LKY of Singapore

Encouraging borrowing while trying to deleverage is impossible. The debt problem in China was a world-wide source of concern for years before Trump’s tariff war. It appears they have now painted themselves into a corner. Failure to avoid an overdue financial crises and recession might mean collapse of the government and a massive loss in public acceptance in a command economy.Trying to avoid it altogether means making the inevitable much worse.

And China’s stock market was among the worst performers last week falling almost 8%; we lost about half that.

China tries to boost its economy, as long trade fight looms with Trump

Pompeo’s Beijing visit begins with testy exchange

By David J. Lynch and

Danielle Paquette Washington Post

October 8 at 8:18 PM

China is redoubling efforts to protect its slowing economy from the effects of a trade war with the United States, providing fresh ammunition for President Trump’s claim that Washington enjoys the upper hand in the deepening commercia…

This could be the biggest economic development this decade:

Archive link: https://archive.ph/VRPiK

Chinese start paying their mortgage before their projects finish. This in turn serves as easy financing for developers:

Like the vast majority of Chinese homebuyers, they had begun making payments before construction was completed. For years, this type of arrangement, which accounts for more than 80% of China’s home sales, gave developers easy access to funds and fueled rapid expansion as home prices soared.

This is extremely pro-cyclical. It works great when property prices go up, but once set in reverse, it will eat the whole economy alive:

The property sector accounts for about a quarter of China’s economy, and its deterioration is spreading financial duress among domestic industries.

The red-hot real estate industry has contributed immensely to China’s rapid economic rise and the dream of home ownership. With more than half of household wealth tied up in housing, the repe…

These rich people have been wanting to leave forever, but they can’t leave. Also, it’s not the multi-millionaires that drive the economy. If only millionaires shop at Amazon, its market cap will be 1B instead of closing in on 500B. It’s the middle class we need to keep an eye on.

Indian Tech Moguls Urge Modi To Be Tougher on Chinese Rivals

Title is baiting because…

Leaders in India’s technology industry are urging the country to go even further to protect the interests of local companies against foreign rivals, or risk ceding the world’s fastest growing internet arena to Chinese and American monopolies.

The rise of protectionism will eventually lead to the demise of international trade amongst big nations. Small nations would have to join economic trading bloc hosted by those big nations. India wants to be one of those few

With this change, I’m more bullish on China’s long term economy. Before the country is ready for the next political stage, this might be a very good option for 20 years.

Whether China will slow down and by how much is the macro question of our time. It affects everything from global political order to how much our houses are worth in the States. Found this FT article that presents a counter-argument to the conventional wisdom that China must slow down drastically from here. Since I don’t have subscription to the FT I found this site that just pirated the whole article… http://cool2watch.com/index.php/2017/06/22/inevitable-chinese-slowdown-a-myth/

Some excerpt:

…based on comparisons with its more developed neighbours, Mr Lueth argues it is “a myth that the growth of China’s Asian peers slowed when they were at China’s level of development, as measured by GDP [gross domestic product] per capita”.

Taiwan managed to sustain growth rates of around 7 per cent a year for a decade after reaching China’s current level of GDP per head at purchasing power parity, around $11,000, in 1992. South Korea even managed 8 per growth for a period, having re…

Many issues, except real estate. Or education, which is interesting since (according to Wikipedia) he studied at Hangzhou Teacher’s Institute and was lecturer at a university. Perhaps he is jaded after being rejected by Harvard (10 times) and not finding employment after earning a grad school degree in business. He says, “I even went to KFC when it came to my city. Twenty-four people went for the job. Twenty-three were accepted. I was the only guy …”. He talked about inclusiveness and the need for more corporate citizenship to strengthen the social safety net. It’s an important issue which more leaders in the modern economy should consider, IMO.

Incidentally, I was just finishing a book which mentions Jack Ma where he brings up Taoism as being a big influence in the way he (and many Chinese) views life and work. It concludes that Chinese see invention as more of a discovery, creatio in situ. Maybe stereotypical to say so, but “Western approach is the way of the boxer. Jack’s w…

What kind of stocks benefit?

CAT and DE?

This article is too good to pass. I read it twice to make sure I soak in the details…

A few years ago, Chinese innovation meant copycats and counterfeits. The driving force is now an audacious, talented and globally minded generation of entrepreneurs. Investors are placing big bets on them. Around $77bn of venture-capital (VC) investment poured into Chinese firms from 2014 to 2016, up from $12bn between 2011 and 2013. Last year China led the world in financial-technology investments and is closing on America, the global pacesetter, in other sectors.

China’s 89 unicorns (startups valued at $1bn or more) are worth over $350bn, by one recent estimate, approaching the combined valuation of America’s (see chart 2). And to victors go great spoils. There are 609 billionaires in China compared with 552 in America.

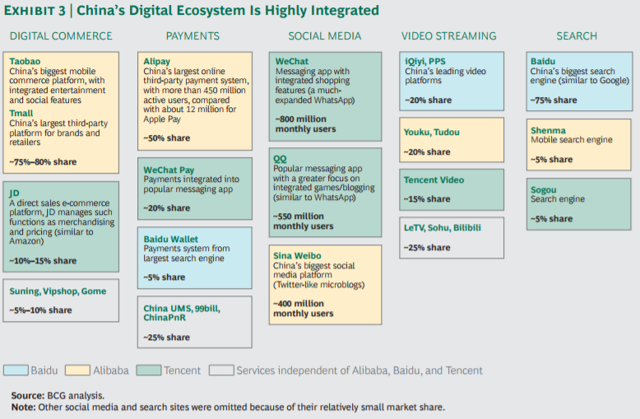

[image]

[image]

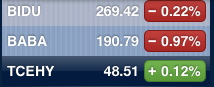

Most hot China stocks listed in USA are associated with one of the BAT.

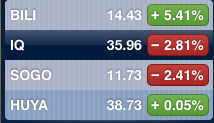

Recent hot IPOs are BILI, IQ and HUYA.

BILI is a youth-generated video-sharing site + interactive live video streaming. Is the only company that is not owned by any of the BAT.IQ streaming video (movies, TV shows) - known as Netflix of China. iQiyi (IQ) is a spinoff from Baidu (BIDU). BIDU owns 70%.HUYA streams game video, spinoff from YY. Known as Twitch of China. TCEHY owns 35%.

Hot & not listed TMD aka the new BAT .

2 Likes

hanera

July 19, 2018, 8:18pm

3

HUYA drops below my purchase price on Jul 11. The other threes are still higher.

Suddenly investors start selling cloud and SAAS stocks. Cloud Kings also tumble.

manch

July 19, 2018, 8:21pm

4

These are super volatile names.

manch

July 19, 2018, 8:21pm

5

Oh I just started buying RHAT.

manch

July 19, 2018, 8:23pm

7

Those are free as gifts. Can’t be bought.

1 Like

hanera

July 20, 2018, 11:04am

10

Yuan is dropping fast dragging China stocks down with it😫

Elt1

July 20, 2018, 1:21pm

11

The Shanghai index is down to where is was years ago. Strictly a stock pickers market. Prices were higher in 2007

hanera

July 20, 2018, 10:45pm

12

Apparently these stocks, IQ, HUYA and BILI were chased by newbie millennial retail investors. Could be a bubble, right?

Meanwhile, Chinese yuan slides, spooking Asian stocks, as trade war fears heighten

China stocks at a historic low. Watch for an eventual blow-your-socks-off rebound.

tomato

July 20, 2018, 11:12pm

14

with china it could just be 50% down, then 50% up

1 Like

manch

July 20, 2018, 11:25pm

15

China’s stock market is for gamblers. If you look back even further it’s completely divorced from the real economy. The quality companies are listed either in Hong Kong or the US. What’s left are mostly crap.

China’s financial market is light years behind the west. I wouldn’t read too much into its performance.

hanera

July 20, 2018, 11:29pm

16

I think Mr T is referring to these companies. Anyhoo, investing in these stocks is an investment in the future. We need to have stakes in both countries. These two countries are going to affect the global economy the most. How many more are coming? Hardly any choices for investment.

manch

July 20, 2018, 11:32pm

17

I have been buying BABA calls everyday. It’s very undervalued.

hanera

July 20, 2018, 11:33pm

18

I take it that you’ve done your due diligence because I don’t really know much about Alibaba except for Mr Ma’s speeches.

manch

July 20, 2018, 11:39pm

19

With BABA and 10c you can’t really go wrong. They are the two and only two tech giants in China.

BABA just invested in Toutiao to counter 10c. They have a new rule. Whichever company that takes money from one Ma can’t take money from the other Ma. One horse rule.

hanera

July 20, 2018, 11:49pm

20

CCP is comfortable these biggies control most of the companies in China?

马化腾 was born in Chaoyang District, Shantou, Guangdong. The total population of Guangdong was 104,303,132 in the 2010 census, accounting for 7.79 percent of Mainland China’s population.

马云 was born on 10 September 1964 in Hangzhou, Zhejiang. As of 2017, its nominal GDP was US$767 billion (CN¥ 5.18 trilion), about 6.26% of the country’s GDP and ranked 4th among province-level administrative units.

李彦宏 was born in Shanxi Province. Empress Wu Zetian, China’s only female ruler, was born in Shanxi in 624. The GDP per capita of Shanxi is below the national average.